0+

Years of Innovation

0+

Countries

0+

Clients

0+

Decisions

Fintech Lending Toolkit

ADEPT Decisions Platform

Our highly configurable ADP Decision Engine supports the implementation of Machine Learning Models, to manage best practice A/B testing of strategies which will continually optimise your credit portfolios.

ADEPT Decisions Platform

Manages decisions on all credit products

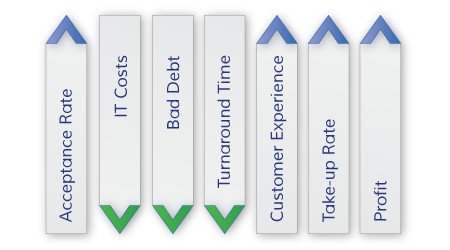

Profit Levers

Return on Investment First

- Manage all profitability levers

- Make more profitable credit decisions

- Optimise terms and conditions

- Assign customers affordability-driven limits

- Ensure more accurate customer decisioning

- Lower the overall cost of customer acquisition

- Rapid champion-challenger strategy modifications at your fingertips

Our Clients

We provide customer decisioning, credit risk consulting and advanced analytics to 35+ clients. The wide range of clients we serve highlights the flexibility of our fintech toolkit.

What clients are saying

What clients are saying

Book a Consultation

Our fintech toolkit includes a decision engine, credit risk consulting and advanced analytics to automate and simplify your lending decisions.

Contact us to learn more about how our credit decisioning solutions can benefit your business.

Find Us

Elm House, St Julian’s Avenue,

St Peter Port, Guernsey GY1 1GZ,

Channel Islands