A Duo of Consulting Services

Introduction

Every company, at one time or another will require external assistance to solve an internal challenge. Challenges can range from an assessment of existing strategies, procedures and policies to the launch of new products and services.

These types of challenges often require an external professional services company, which can look at the challenges from a third-party viewpoint. The external consultancy can then provide solutions based on experience gained from working with peer group companies in the industry.

Each member of the ADEPT Decisions team has over twenty years of experience in consumer credit risk management and analytics and have operated across the EMEA region.

Our consultants have a track record of increasing the portfolio profitability of credit grantors of all types, including major banks, retailers, personal loan providers, micro-lenders, telcos and fintechs.

Here are two popular consulting services which we provide for our clients:

1. Originations Strategy Assessment

The Originations Strategy Assessment is a service offered by our highly experienced credit risk professionals to review the credit granting strategies in place at your organisation.

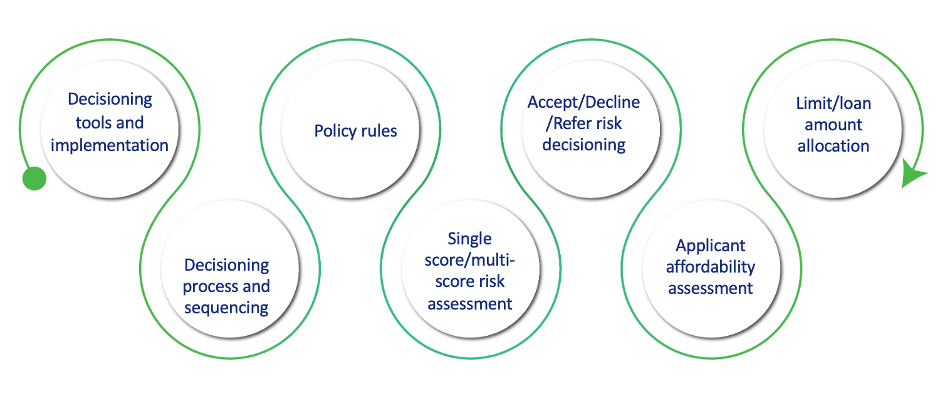

Our consulting team will engage with your credit team to fully understand your end-to-end credit granting process, with a specific focus on the following areas:

In order to validate your current originations strategies, and to identify opportunities for improvement, our team will analyse historical application data, outcomes and performance. This analysis will be performed using your own data, to ensure complete alignment with your application base.

All strategic elements of your credit decisioning will be data validated to determine the impact on your business success.

The deliverable from the Originations Strategy Assessment is a detailed presentation, and we will make a minimum of 5-10 recommendations for improvements to your credit products originations strategies.

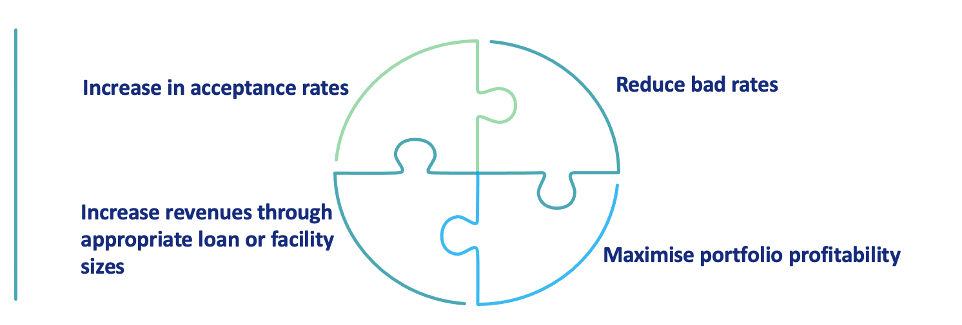

These recommendations will be backed up with outcomes from analysis to ensure that they will maximise the profitability of your credit products.

Recommendations will be structured such that they are implementable in a champion/challenger testing framework if these tools are available.

The focus of the Originations Strategy Assessment can be targeted by the business to concentrate on one or more of the following organisational objectives:

2. Roadmap to Digitisation

Many credit-granting organisations have one single significant barrier to business growth. The reliance on manual credit granting limits significant expansion in the customer base and traps the business in high-overhead decisioning that operates at the whim of underwriting staff.

The Roadmap to Digitisation is focused on the following organisational objectives:

- Increase application throughput to enable business scaling and growth

- Reduce turnaround times to increase customer satisfaction

- Make credit decisioning consistent and controllable by management

- Improve credit portfolio quality

Digitisation of the credit journey is crucial for business growth, as it will enable consistent and speedy originations that will delight your customers and run rings around your competition.

Top tips for achieving these goals through digitisation include:

- Limit the amount of data that customers need to capture

- Reduce turn-around times and grant loans faster

- Accept the customers that are right for your business

- Deliver appropriate credit exposure to each applicant

- Maintain measurable decisioning that is consistent across all applications

The ADEPT Decisions team will work with your organisation to understand the current processes, obstructions to digitisation and opportunities to expand lending.

We will review credit assessment criteria, operational set-up, turnaround times and key performance indicators to identify where opportunities for improvement exist and recommend solutions to challenges that are currently holding back your digitisation plans.

The deliverable from the Roadmap to Digitisation is a detailed report, wherein we will present the current and future view of the credit assessment process, along with solutions that will remove bottlenecks and drive consistency at each step in the process. All recommendations will be prioritised based on their potential impact on the business and their ease of implementation.

Summary

All of our consulting services have one thing in common: practical solutions from experienced experts in the global credit industry. We will never “borrow your watch to tell you time” nor will we produce endless academic reports with suggestions that can never be implemented.

Our consulting approach is to provide value, and make common sense recommendations that are practical and can be implemented in the short to medium term.

This is why so many of our clients recommend ADEPT Decisions consultants.

Contact Us

For more information about the two consulting services, plus all of the other engagements we can provide, email: newsletter@adeptdecisions.com

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing FinTechs with decisioning software and analytics to level the playing field, promote financial inclusion and support a new generation of financial products.