Our team delivers a complete range of consulting services that are tailored to the specific requirements of clients in both emerging and established markets. We have 100+ years of combined experience working with all consumer credit and SME lending products in over 30 countries.

External Assistance to Solve Business Challenges

At one time or another, specialist assistance is required to solve a business challenge. These types of challenges benefit from external experts who can provide solutions based on aggregated perspectives gained from the industry.

Each member of our team has over twenty years of experience in consumer credit risk management and analytics. We have delivered assignments to all types of credit grantors, including banks, SMEs, retailers, digital lenders, micro-lenders, telcos and fintechs.

Originations Strategy Assessment

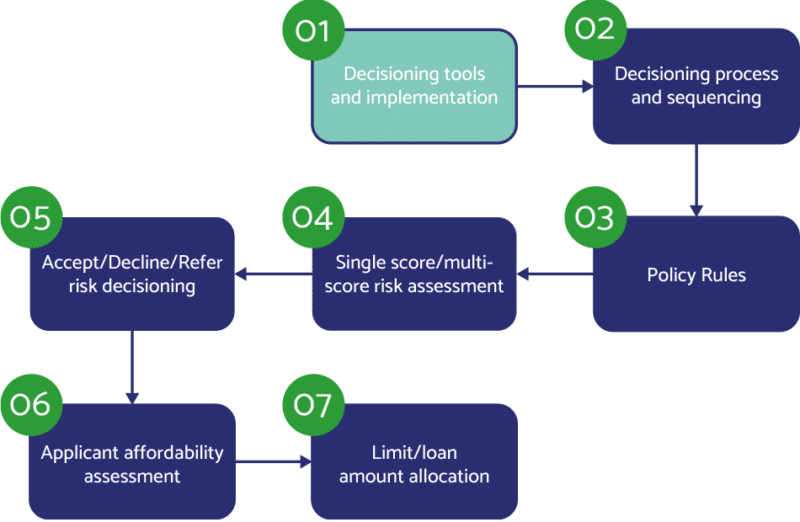

Our consulting team will engage with your credit team to fully understand your end-to-end credit granting process, with a specific focus on the following areas:

In order to validate your current originations strategies, and to identify opportunities for improvement, our team will analyse historical application data, outcomes and performance. This analysis will be performed using your own data, to ensure complete alignment with your application base.

All strategic elements of your credit decisioning will be data validated to determine the impact on your business success.

The deliverable from the Originations Strategy Assessment is a detailed presentation, and we will make a minimum of 5-10 recommendations for improvements to your credit products originations strategies.

These recommendations will be backed up with outcomes from analysis to ensure that they will maximise the profitability of your credit products.

Recommendations will be structured such that they are implementable in a champion/challenger testing framework if these tools are available.

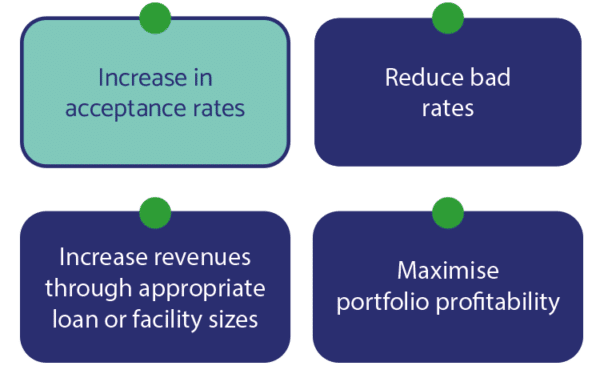

Focus on Business Objectives

Roadmap to Digitisation

Many lenders have one single significant barrier to business growth. The reliance on manual credit granting limits significant expansion in the customer base and traps the business in high-overhead decisioning that operates at the whim of underwriting staff.

The Roadmap to Digitisation is focused on the following organisational objectives:

Increase application throughput to enable business scaling and growth

Reduce turnaround times to increase customer satisfaction

Make credit decisioning consistent and controllable by management

Improve credit portfolio quality

Our consultants will work with your team to identify current processes, obstructions to digitisation and opportunities to expand lending.

We will review credit assessment criteria, operational set-up, turnaround times and key performance indicators.

We will identify opportunities for improvement and recommend solutions to challenges that are currently holding back your digitisation plans.

The deliverable from the Roadmap to Digitisation is a detailed report, presenting the current and future view of the credit assessment process. This will include solutions that will remove bottlenecks and drive consistency at each step in the process.

All recommendations will be prioritised based on their potential impact on the business and their ease of implementation.

Wide Range of Consulting Services

Other examples of consulting services that we deliver include:

Collections Situation Analysis

Applications Processing Review

Credit Operations Audit

Risk Department Overview

Decisioning Strategy Design and Reviews

Interim Management Assignments

Flexible Engagements

All of our consulting engagements are delivered on a flexible basis, customised to your specific requirements. For each assignment, you can elect what the specific focus of the deliverables should be and for how long.

Assignments can be scheduled on a fixed-price or retainer basis and the key deliverable is to always deliver tangible business benefits, with a strong focus on common sense recommendations that will rapidly add to your bottom line results.

Why Clients Recommend Us

All of our consulting services have one thing in common: practical solutions from experienced experts in the global credit industry. We will never “borrow your watch to tell you the time” nor will we produce endless academic reports with suggestions that can never be implemented.

Our consulting approach is to provide value, and make common sense recommendations that are practical and can be implemented in the short to medium term.

This is why so many of our clients recommend ADEPT Decisions consultants.