Use our intuitive, highly flexible and robust ADEPT Decisions Platform to quickly design and manage strategies while eliminating integration and deployment headaches.

Rapid and low-cost set-up with free and automatic updates and ultra-fast performance

Highly flexible, enables the rapid roll-out of all digital lending and fintech products

User friendly web-based interfaces with video tutorials and free support and training

Test and Learn Easily run multiple A/B test strategies to continually test and learn

What-if analysis enables low risk strategy design and deployment

IT resources not required for strategy changes, placing the risk team in the driver’s seat

Best use of telco data, alternative data and AI techniques to accurately manage risk

Strategy consulting and training ensure that clients maximise their A/B test results

Fully configured for each unique operating environment

Software as a Service

means you only pay for what you use, with no maintenance fees and a 99.99% uptime

Transparent fees minimise currency risks for a client

Minimal upfront and usage fees enable accurate budgeting and a rapid ROI

ADEPT Decisions Platform Features

Data Security

ADEPT Decisions Platform uses best practice industry standard data security protocols

Reduced Capital Expenditure

No need to provision expensive design and runtime servers and surrounding infrastructure. No ITOps costs.

Multi-Tenant

True multi-tenant solution with subscriber data stored in separate silos – no overlap of data or strategies

Seamless Upgrades

Users always have access to the latest version of the Decision Engine, without any integration or deployment costs

Scalability

Processing capacity scales automatically with demand. No wasted resources

Value for Money

Modular solution for maximum flexibility and cost savings – value for money menu approach

How does the ADEPT Decision Engine boost fintechs to the next level?

Here are some of the features of the ADEPT Decision Engine that enable lenders to evolve credit assessment beyond just basic Loan Origination System decisioning. Use the quick links to find the one you are looking for.

Policy Rules Implementation

Policy Rules are implemented directly into the ADEPT Decision Engine, using a comprehensive and user editable rule library.

Most Loan Origination Systems will enable the implementation of basic rules, but do not allow for continuous modification by business users.

This feature of the ADEPT Decision Engine ensures that the credit risk team’s time is spent on the things that matter, rather than justifying the need to allocate precious IT resources on simple changes.

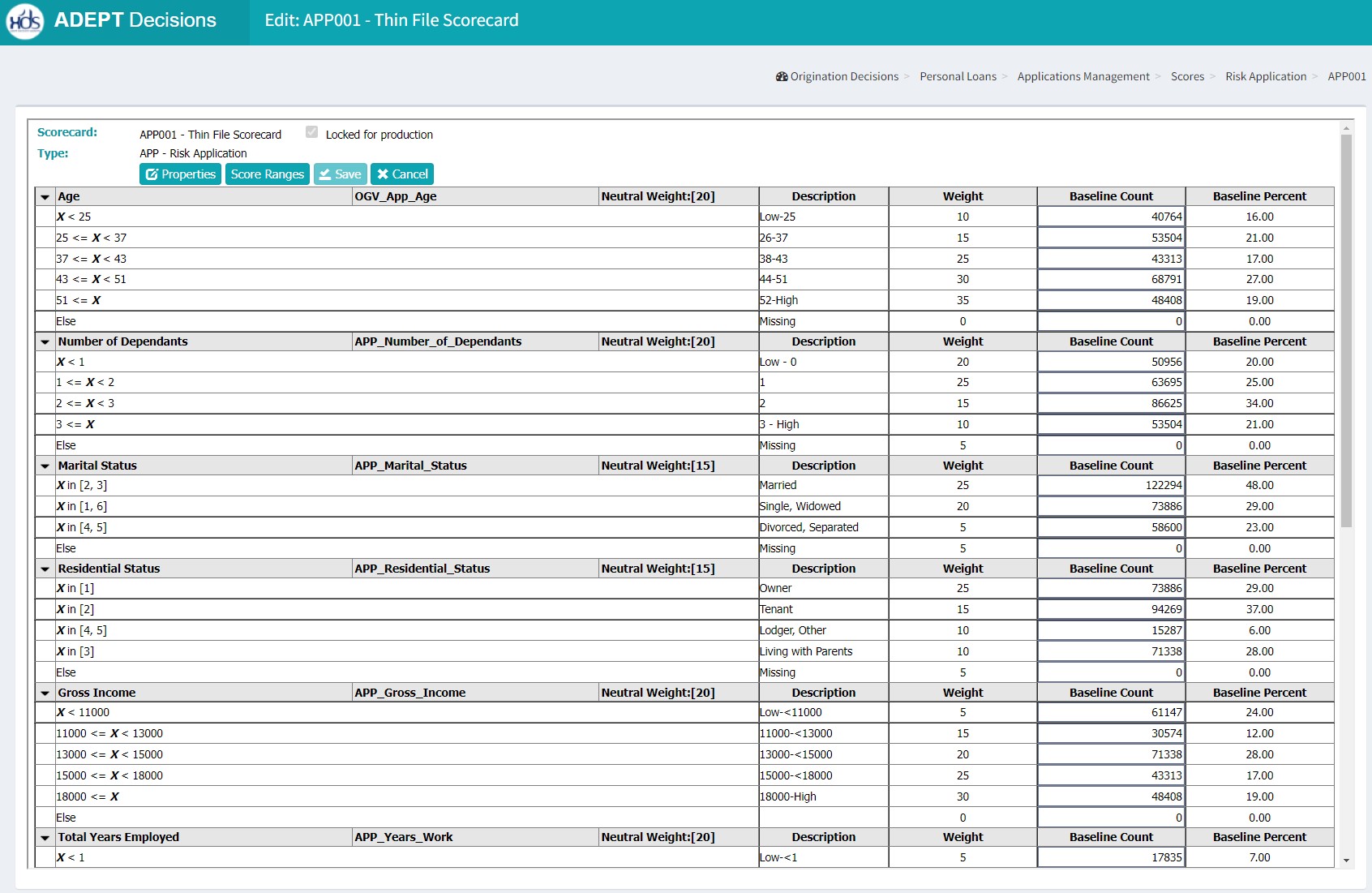

Traditional Scoring and Adverse Actions

Traditional scorecards can be easily implemented into the ADEPT Decision Engine. Adverse Actions can be used to provide feedback to your frontline team explaining why an application may have been declined. Complex calculations can be configured directly in the ADEPT Decision Engine to derive scorecard characteristics.

Most Loan Origination Systems can only implement limited versions of this type of model, and often lack the ability to generate characteristics or adverse actions.

Non-Traditional Models implementation

One of the most important aspects of building a new model is the actual implementation. The ADEPT Decision Engine makes implementation easy, by providing two key model operationalisation options. Simpler models, such as logistic regression, can be implemented directly through the Scoring Function. More complex Ensemble Models, such as Random Forests or XGBoost Models, can be implemented by calling an external service.

Most Loan Origination Systems cannot implement any models other than traditional scorecards.

Complex Segmentation Tools

The ADEPT Decision Engine segments applications into treatment groups using decision trees and matrices. These tools enable business users to perform a granular level of grouping, whilst keeping the strategies visual.

A typical Loan Origination System provides for simple score-based cut-offs for making Accept/Decline and loan size decisions.

However, a Loan Origination System does not have the capacity for complex strategies that optimise approval decisions, exposure setting and pricing.

Flexible Decision Process

The ADEPT Decision Engine has a flexible strategy process. As part of the solution configuration, our project team works with the client’s team to define the sequence and type of each process step required to fully assess an application.

This enables the ADEPT Decision Engine to deliver a wide variety of decisioning outcomes, including the Accept/Decline decision and loan size, plus any other decisions that the client may wish to make at the same time. This could include pricing terms, maximum and minimum loan tenure, ancillary products to be offered, etc. By adding these additional levers into the application assessment, lenders can have a far greater control over their own profitability.

Loan Origination Systems typically do not have a flexible decision process. The decisioning that they offer is rigid and limited to simple risk assessment and loan/limit assignment.

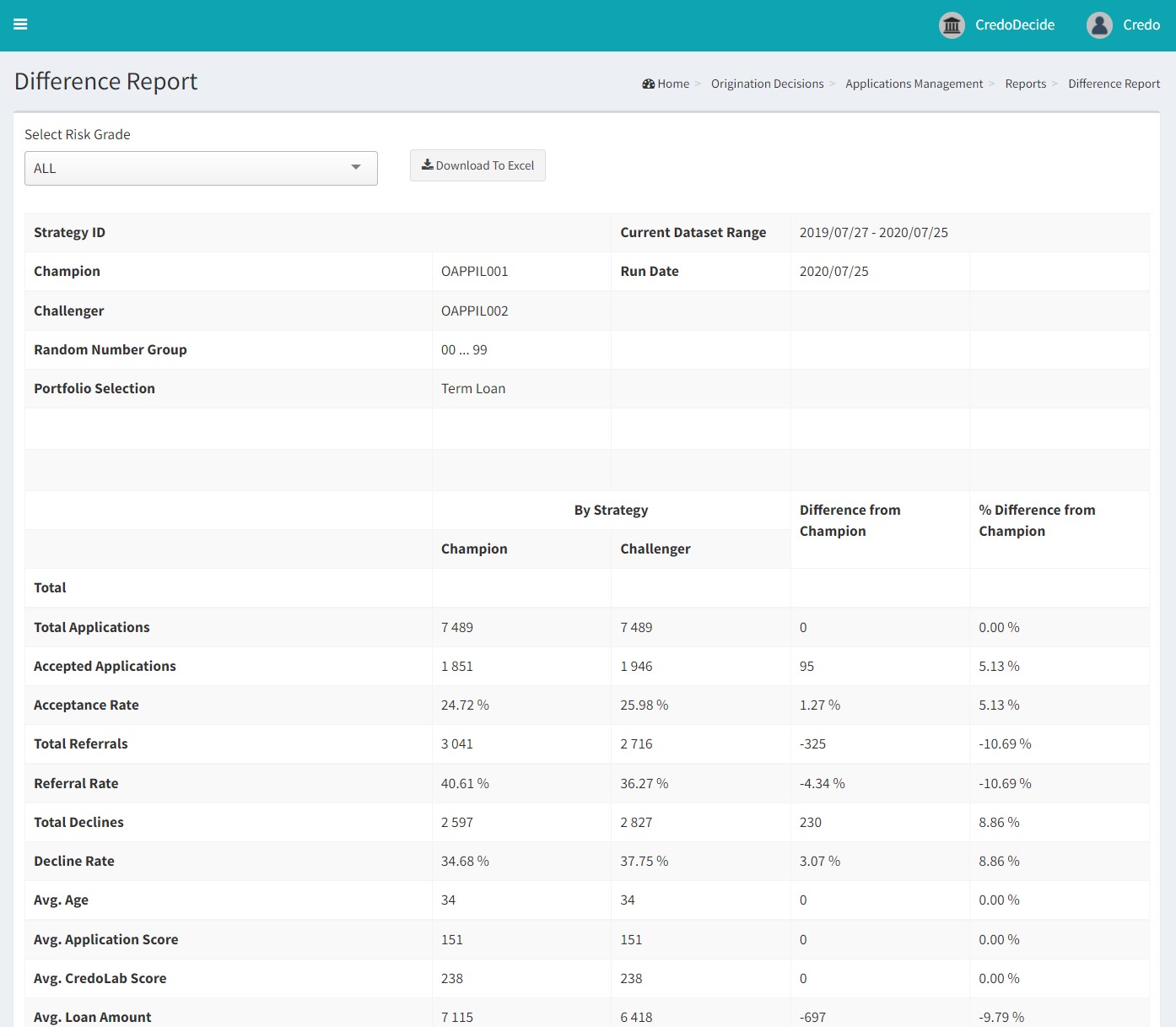

What-if Analysis

When credit risk managers and analysts plan to make changes to strategies, it is best practice to first understand what the combined impact of the changes is likely to be on the portfolio. This should be done before releasing the strategy into production.

The ADEPT Decision Engine provides a built-in, what-if analysis capability, which enables credit risk managers to easily run historical application data through strategies to measure the expected impact. The decision engine creates side-by-side comparison reports between the existing and new strategies, which highlight the expected changes in the relevant metrics.

Loan Origination Systems do not typically provide what-if functionality, meaning that changes to strategies cannot be evaluated before being released.

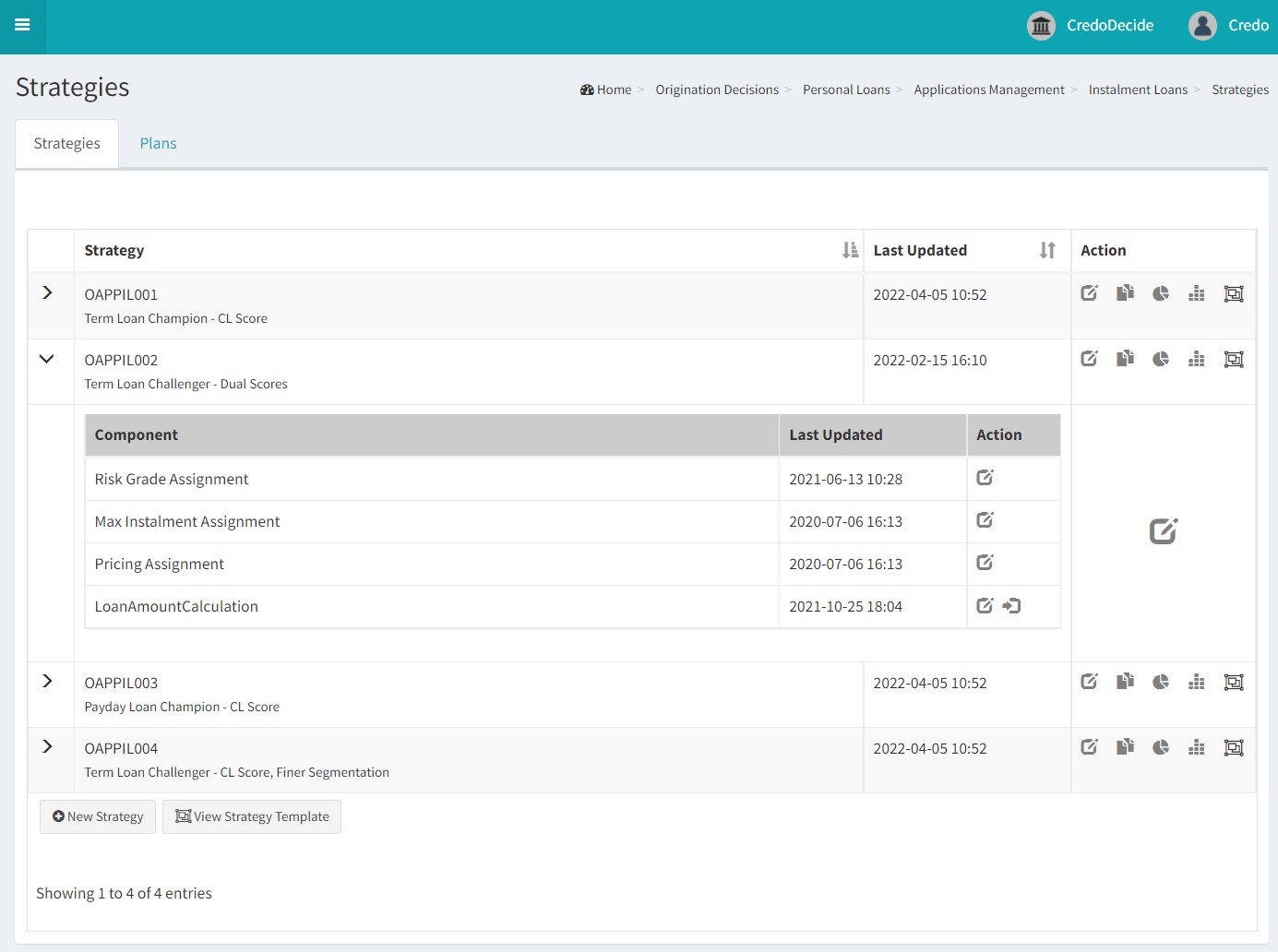

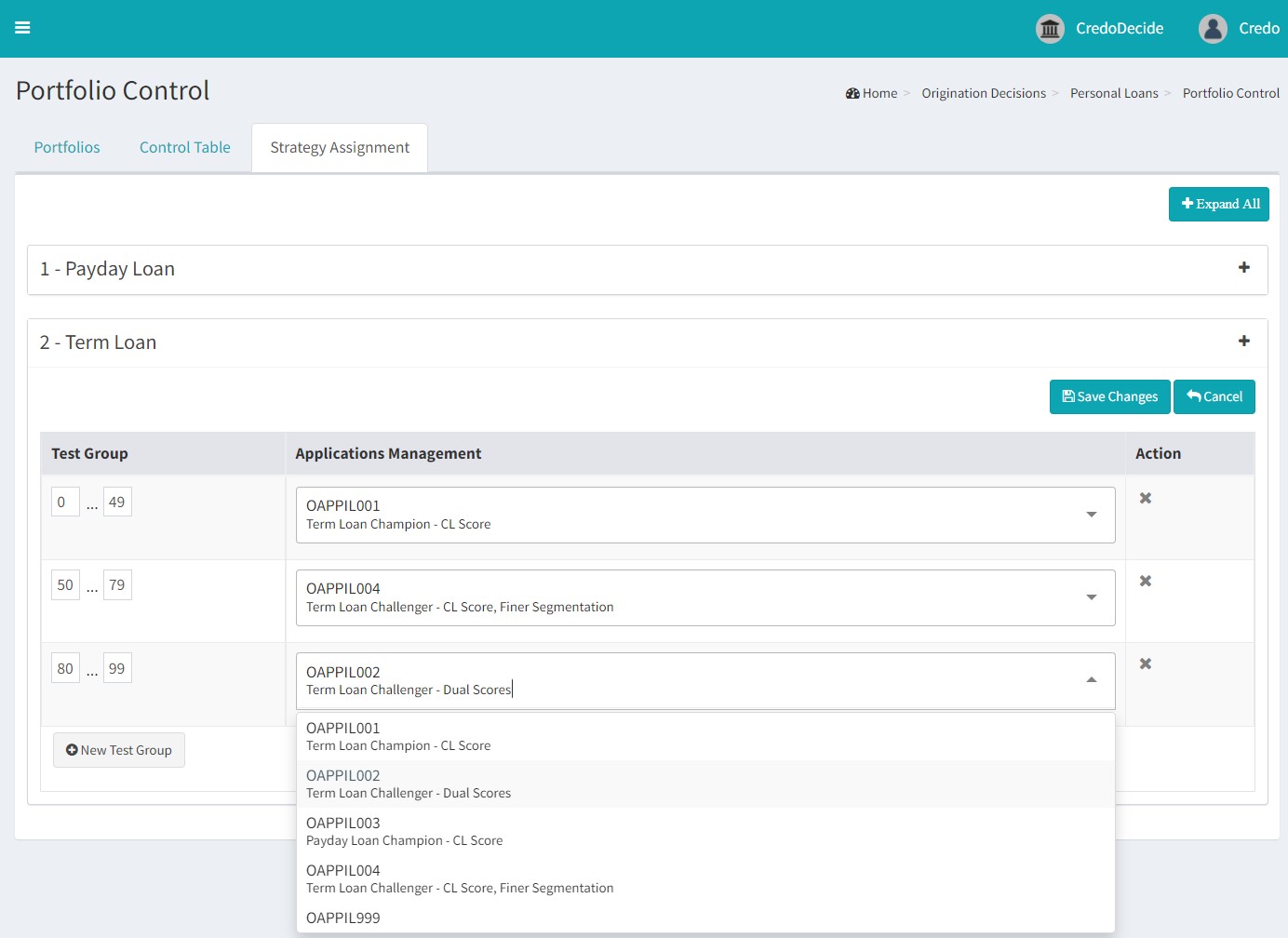

A/B Testing

The ADEPT Decision Engine enables the credit risk team to simultaneously assign multiple decision strategies to credit applications. A/B testing is then conducted on a random allocation of applications in each different strategy.

The ADEPT Decision Engine assigns a test number to each application that is received. Strategies can be assigned to percentages of the portfolio, which means that new strategies can be tested on a random selection of applications. The credit risk team can select what percentage of applications each strategy receives.

Applications can be monitored by the strategy that is assigned in order to determine which strategy is the most profitable to the business.

This ability to run A/B tests on different strategies is paramount to controlled credit risk management and cannot usually be found outside of decision engines.

Real Time Dashboards

The ADEPT Decision Engine includes a real-time updated dashboard that can be accessed by business users at any time to track credit decisioning KPIs. These dashboards make it possible for the credit team to track trends in acceptance rates, scores, limit allocation etc.

Dashboards can be filtered by date range, credit portfolio and also by strategy. Filtering by strategy provides continually updating feedback on the performance of A/B Testing strategies. These tools are critical to the credit risk management team to ensure that they capitalise on changes in the lending environment.

Typical Loan Origination System reporting tends to be operational and is related to the entire application process and does not provide a detailed view of the credit decisions being taken.

What clients are saying