Fintech Lending Toolkit

ADEPT Decisions Platform

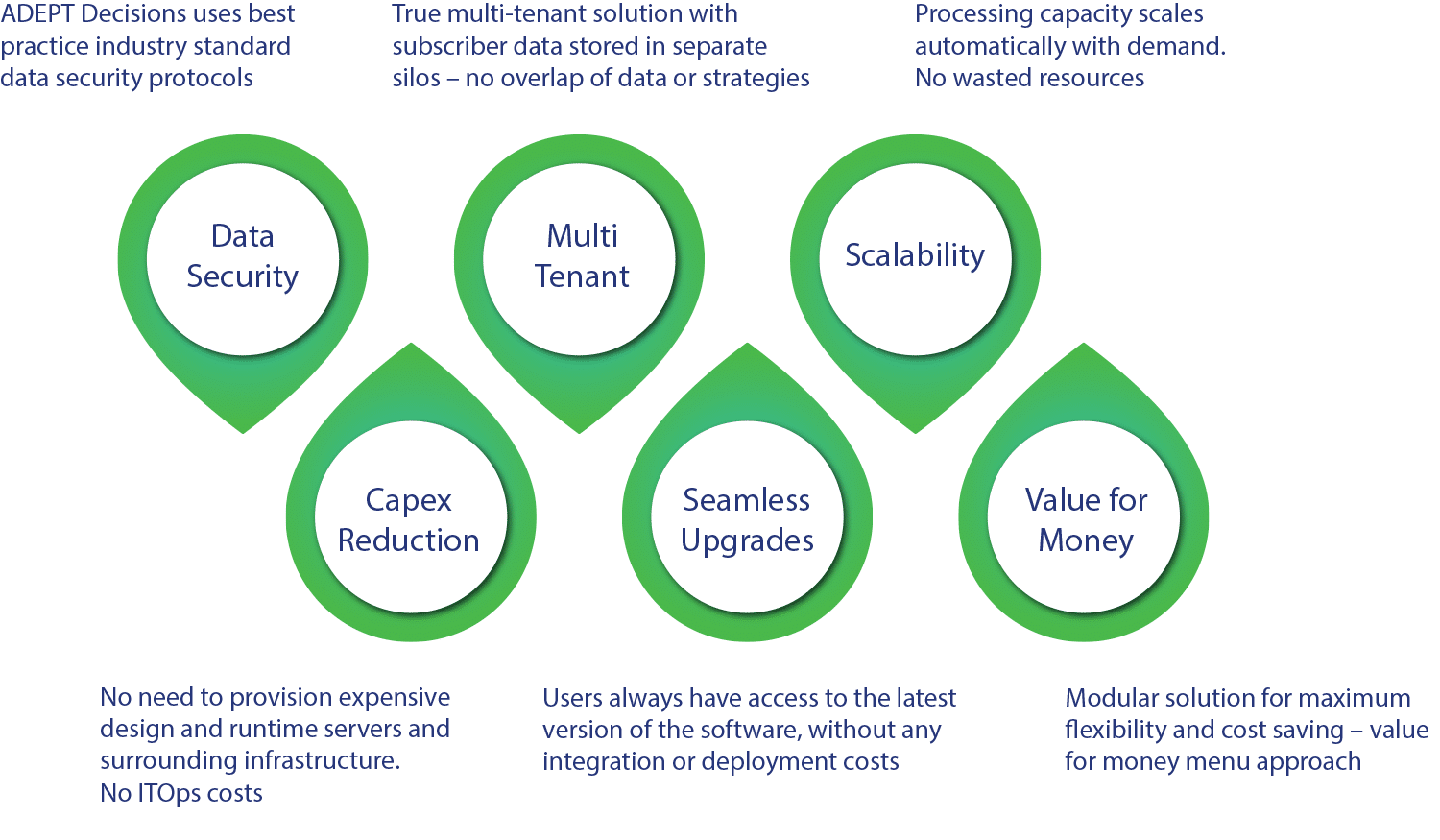

ADEPT Decisions Platform Features

The ADP Decision Engine is a no-code, cloud-native, feature rich credit risk management solution for lenders of all types and sizes.

ADEPT Decisions Platform

Manages All Credit Products

Credit Life Cycle Customer Decisioning

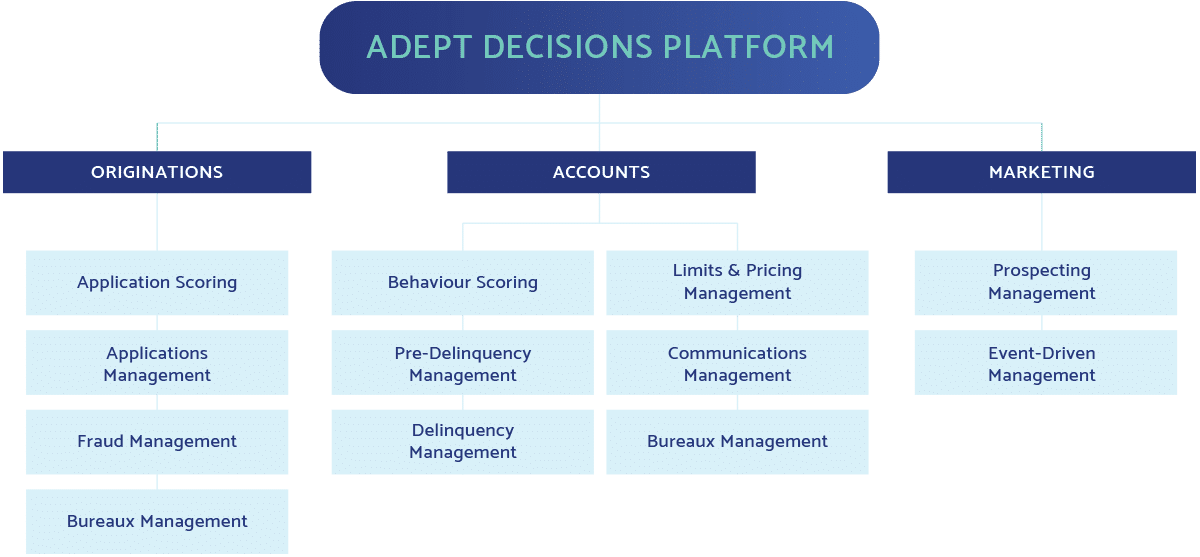

The ADEPT Decisions Platform is a modular Decision Engine with 3 components:

- Originations Management

- Accounts Management

- Marketing Management

This modular approach enables lenders to implement consistent credit, collections and marketing strategies using a single Decision Engine across the entire customer life cycle.

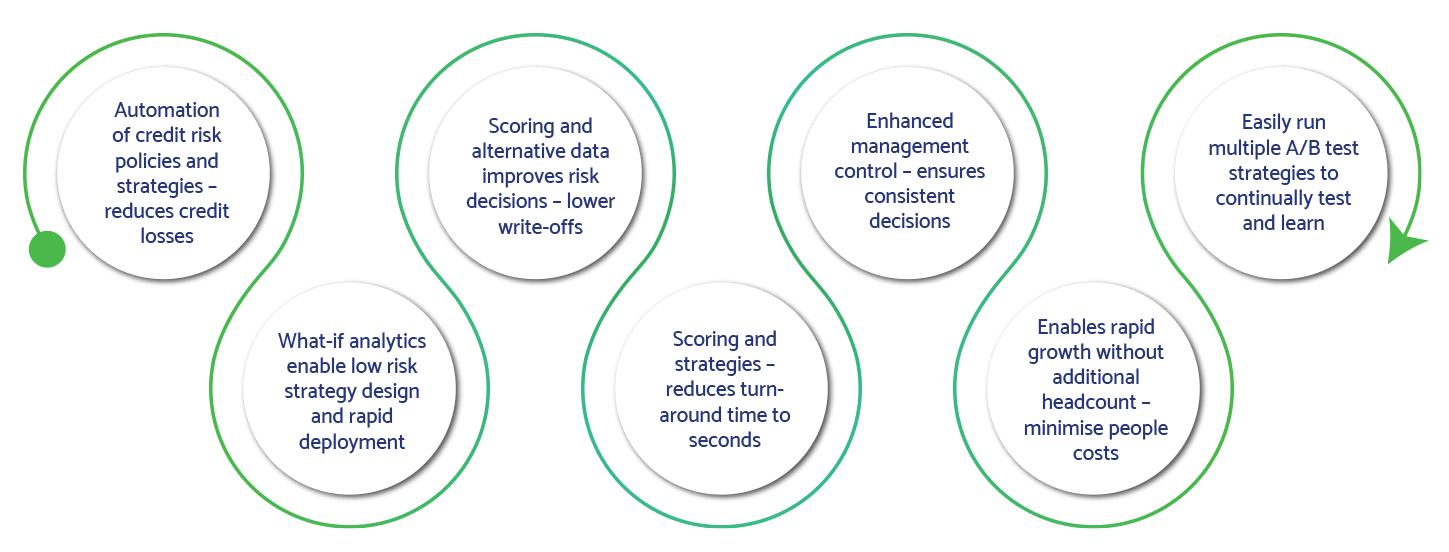

ADEPT Decisions Platform Benefits

The ADEPT Decisions Platform provides multiple benefits to a wide range of lenders.

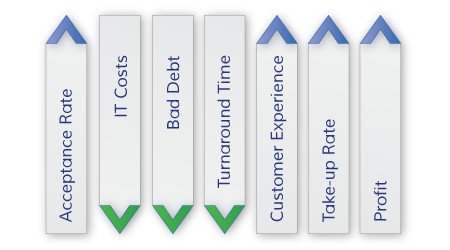

Profit Levers

Return on Investment First

- Manage all profitability levers

- Make more profitable credit decisions

- Optimise terms and conditions

- Assign customers affordability-driven limits

- Ensure more accurate customer decisioning

- Lower the overall cost of customer acquisition

- Rapid champion-challenger strategy modifications at your fingertips

Our Clients

We provide customer decisioning, credit risk consulting and training, and advanced analytics to 35+ clients. This wide range of lenders highlights the flexibility of our fintech lending toolkit.