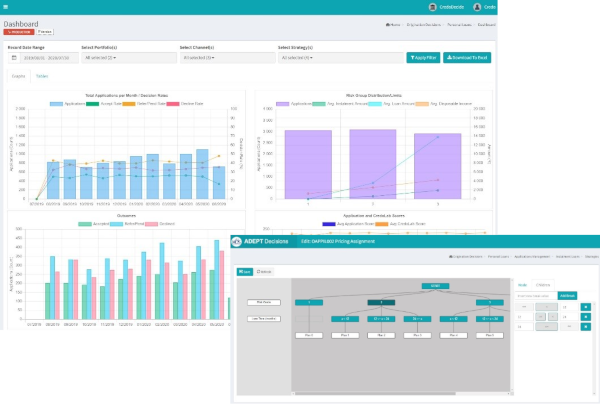

The ADEPT Decisions Platform supports the implementation of Machine Learning Models, to manage best practice A/B testing of strategies which will continually optimise your credit portfolios.

Why do you need a dedicated Decision Engine?

Determining appropriate risk-based limits, terms and conditions for all credit applications is the core principle of any credit grantor. For modern lenders, credit assessment needs to be scientific, constantly evolving, and under the direct control of the credit risk team.

The success of any fintech business rests in the ability to identify appropriate customers and provide them with the products and services that they need.

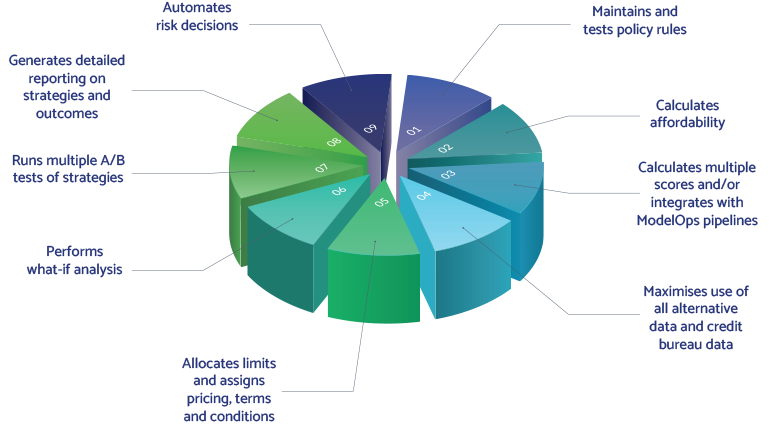

A Decision Engine enables business users to implement and manage all aspects of the lenders credit strategy. A Decision Engine comes equipped with a wide variety of tools which enable users to drive the core competencies of the fintech business.

Using a variety of advanced scorecard types, complex mathematical calculations to determine disposable income and affordability, and simultaneous deployment of multiple competing strategies, a modern decision engine is crucial to the success of any lender.

What is the ADEPT Decisions Platform?