Our Credit Scoring Service evolves to match your changing business requirements.

The Legacy Challenge

The historical approach to scorecard implementation was to hard code the scorecards within a Loan Origination System (LOS). This approach has many drawbacks:

Implementing scorecards is time consuming and reliant upon IT developers.

Changes cannot be made easily to the scorecards as they reside directly in operational code.

Translation of the scorecards from the development platform to integration must be thoroughly validated, to ensure that the implementation is accurate. This process can be very complicated when working with a code-based implementation, which will lengthen the testing cycle.

The scorecard on its own is of limited value without the automation of policy rules and decisioning logic to maximise the benefits of the score.

The CSS Solution

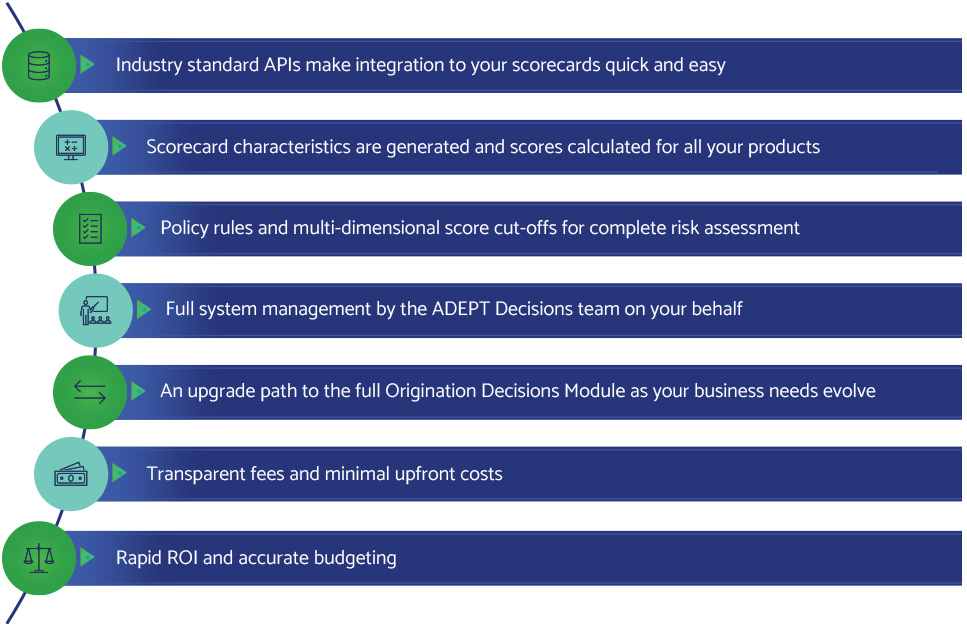

The Credit Scoring Service (CSS) is a managed service, where all APIs, scorecards, policy rules and strategy definitions are maintained within the system on behalf of our clients.

This minimises the effort required by clients to implement scorecards, policy rules and scorecard cut-offs.

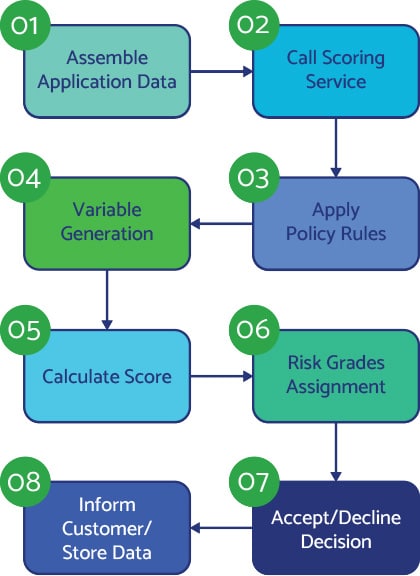

We create a standard API layout which clients are able to call in order to enact scoring and decisioning.

This data layout contains all of the variables that CSS requires in order to apply policy rules, calculate the application score, and to make an Accept/Decline/Refer risk decision.

CSS manages the disposition of applications and generates reports to provide insights and analytics for clients’ portfolios. Lenders benefit from the multiple features of CSS, as the system enables a rapid integration to grow over time with more sophisticated configurations.

CSS is designed to assist our clients in achieving their short and long term goals across all of their consumer and SME loans portfolios. With our solution, lenders are well positioned to offer an unparalleled customer experience at a lower processing cost. CSS provides clients with superior functionality and a rapid go-to-market for any new products.

Our solution has a roadmap for product evolution as our clients business needs evolve and their application volumes increase.

The CSS Solution

The Credit Scoring Service (CSS) is a managed service, where all APIs, scorecards, policy rules and strategy definitions are maintained within the system on behalf of our clients.

This minimises the effort required by clients to implement scorecards, policy rules and scorecard cut-offs.

We create a standard API layout which clients are able to call in order to enact scoring and decisioning.

This data layout contains all of the variables that CSS requires in order to apply policy rules, calculate the application score, and to make an Accept/Decline/Refer risk decision.

CSS manages the disposition of applications and generates reports to provide insights and analytics for clients’ portfolios. Lenders benefit from the multiple features of CSS, as the system enables a rapid integration to grow over time with more sophisticated configurations.

CSS is designed to assist our clients in achieving their short and long term goals across all of their consumer and SME loans portfolios. With our solution, lenders are well positioned to offer an unparalleled customer experience at a lower processing cost. CSS provides clients with superior functionality and a rapid go-to-market for any new products.

Our solution has a roadmap for product evolution as our clients business needs evolve and their application volumes increase.

What does CSS give me?

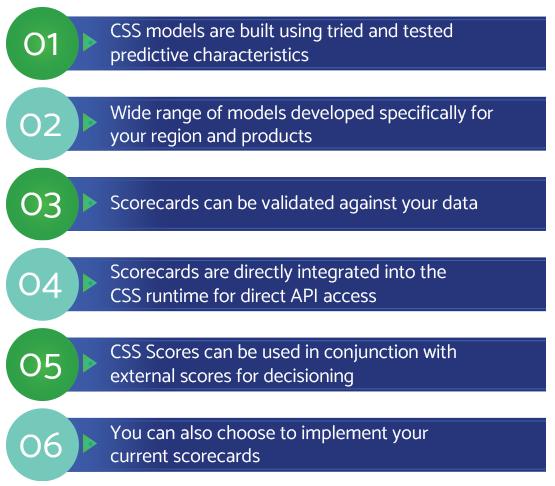

Credit Scoring Service – Scorecards

Processing

Apply Policy Rules

- Rules can reference any data that is input into CSS

- Rules are implemented and maintained in the cloud

- Knock out applications that do not require scoring (e.g. underage)

Calculate application score

- Supports multiple scorecards, segmented by product/other

- Scorecards are implemented and maintained in the cloud

Apply score cut-off

- Create Risk Grades

- Make Accept/Decline/Refer decisions

- Utilise the application score and any other external score (e.g. credit bureau score)

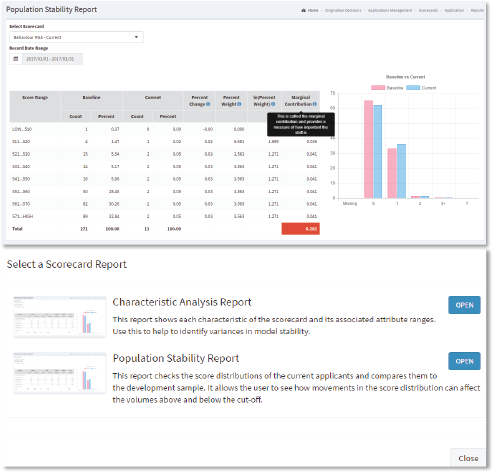

Credit Scoring Service – Reporting Services

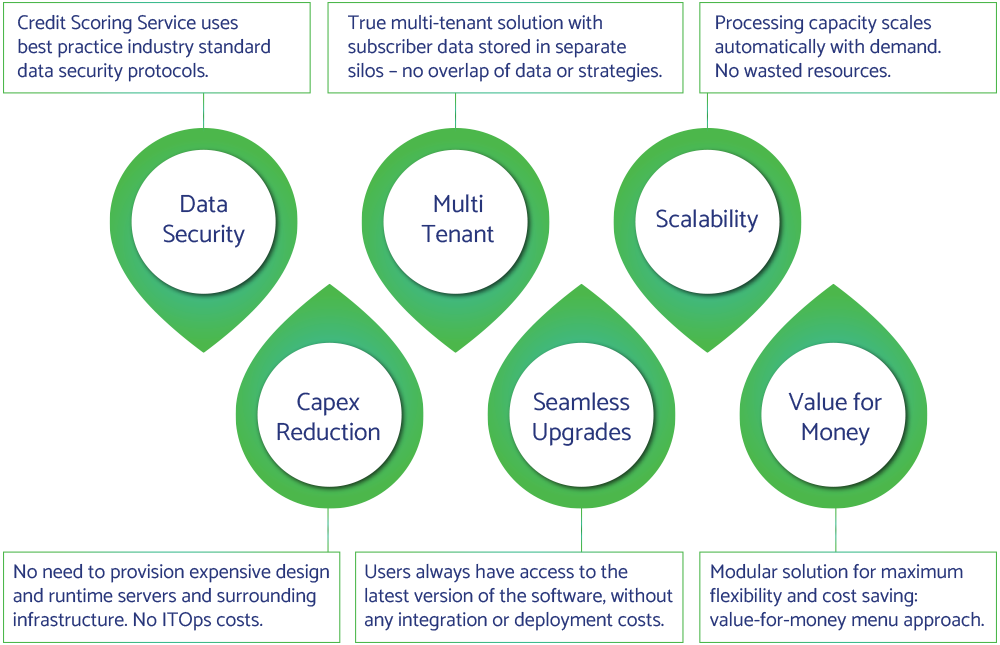

Benefits of our SaaS Solution

What clients are saying