BNPL Credit Risk Implications

Introduction

Sometimes I wonder if the lending industry has more parallels with the fashion industry than we would care to admit to. On the catwalks of New York, London, Paris and Milan, models strut the latest fashions and trends for the season. In the offices of established lenders and fintechs, new and more complex credit products are designed to catch consumers attention, as well as investors.

Buy Now Pay Later (BNPL) is one such lending product which has caught the attention of consumers worldwide and has also fuelled the boom in fintechs, by attracting huge private equity and venture capital funding.

According to Juniper Research, as of 2022, 360 million people used BNPL, and the expected compound annual growth rate is projected at between 20% and 45% through the end of this decade.

Based on these numbers and projections, BNPL has proven to be a ‘fashion hit’ and certainly not a fad!

So before we examine what are some of the credit risk implications of BNPL products, it makes sense to define what it actually is, as there are a number of variations of this product.

What is BNPL?

Investopedia describes the BNPL product very well.

“Buy now, pay later (BNPL) programs have different terms and conditions, but generally, they offer short-term loans with fixed payments and no interest. You can use a BNPL app to make the purchase, or you may have BNPL options through your credit card.”

With BNPL, you can make a purchase at a participating retailer and opt for buy now, pay later at checkout. If approved, you make a small down payment, such as 25% of the overall purchase amount. You then pay off the remaining amount in a series of interest-free installments, usually over a few weeks or months.

The main difference between using BNPL and a credit card is that the credit card generally charges interest on any balance carried over to the next billing cycle. Although some credit cards offer 0% annual percentage rates (APRs), it may only be for a limited time. With a credit card, you can carry a balance or use your credit line indefinitely.

BNPL apps usually don’t charge interest or fees, and they have a fixed repayment schedule. You know your payment amounts up front, and each payment will be the same.

This kind of financing was once most popular for beauty and apparel purchases, but it has branched out into other areas like travel, pet care, groceries, and gas. Most BNPL loans range from $50 to $1,000.

A CFPB report from March 2023 found that users of buy-now-pay-later services were far more likely to have bank overdrafts, payday loans, pawn loans, and other high-interest financial products, indicating that they are more financially vulnerable than non-users of BNPL financing.

Of those who use BNPL financing, the CFPB found that Black, Hispanic, and female consumers were more likely than average to use it, as were consumers with household incomes between $20,000 and $50,000.

As mentioned, buy-now-pay-later financing agreements allow consumers to pay for things over time without interest charges. And it’s possible to get approved for this type of financing even if you’ve been shut out of other loan options due to a low credit score or the lack of credit history.

BNPL loans don’t add to your credit card debt, but they do add to your personal loan debt. They don’t usually affect your credit score unless you fail to pay.”

Credit Risk Implications:

Subprime Applicants

“TransUnion, the Chicago credit reporting agency, found a stronger link to age and credit risk. Its report released Wednesday relied on more than nine million consumers with a point-of-sale (PoS) financing inquiry from the fourth quarter of 2019 to the fourth quarter of 2021.

Gen Zers and millennials (ages 18-40) made up 35% of those in TransUnion’s database of people with active credit, but they accounted for 61% of consumers who applied for BNPL financing during the study period.

TransUnion also found PoS financing applicants were more likely to belong to higher risk tiers. About 43% of all PoS financing applicants were found to belong to the subprime risk tier, compared with 15% of the credit population.

Salman Chand, vice president of consumer lending at TransUnion, said consumers are drawn to BNPL and PoS lending by their simplicity and convenience.

“Consumers who are most likely to utilise Point-of-Sale financing tend to be younger and below prime,” Chand said.

Over Indebtedness

The Corporate Finance Institute describes this risk implication very well:

“When checking out, a consumer would traditionally use a credit card (if they had one) or a debit card. With BNPL, they’re able to actually pay a very small amount (and sometimes nothing) up front and instead split the payments for the total purchase through installments over weeks or months.

BNPL is an interesting and attractive way to access credit for consumers that may not have other forms of payment; perhaps a lack of credit history has precluded them from getting a credit card, for example.

Consumers get quick credit decisions from the BNPL provider so they can focus on the shopping experience. The upfront consumer experience is often more efficient than requesting traditional credit from a lender, due to low consumer regulations for BNPL transactions. For example, consumers do not have to disclose much information to the BNPL provider.

BNPL loans tend to be interest-free for the consumer, though, so there’s a financial incentive to leverage this technology even for buyers who have access to alternative credit and payment sources. There’s a psychological risk here when consumers aren’t paying a lot “out of pocket” up front; they are more likely to make a purchase and may also spend more than they would otherwise.

Consider a buyer who intended to purchase $100 worth of some product online but was given the option to instead pay $25 every two weeks for eight weeks. That consumer may instead purchase more goods.”

Rapid Application Turnaround Time (TAT)

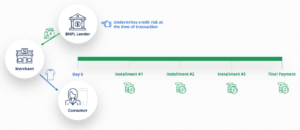

“BNPL (Buy Now, Pay Later) is unsecured consumer credit and an increasingly popular fintech-enabled payment option, most commonly offered on e-commerce platforms. The history of BNPL traces back to the instalment plan – a way to pay for large purchases over time by spreading it over a number of smaller payments.

BNPL is a form of POS (point of sale) financing, meaning that credit is originated directly at the time and point of sale, as opposed to a customer being required to secure credit from a lender or a credit card provider ahead of their shopping experience.”

Due to the nature of BNPL applications occurring at the Point of Sale (PoS) application turnaround time need to be measured in seconds rather than hours or days, which is more typical for mainstream lenders.

This requirement for an ever-faster TAT, which becomes a competitive advantage for fintechs, often means that standard credit granting procedures are circumvented.

Credit Bureau Data and Scores

In a March 2023 article, Payments Dived described the current situation in the USA (Source)

“Buy now, pay later loan information still isn’t being widely reported to credit bureaus, more than a year after those firms announced efforts to collect such information.

At issue is the short-term, no-interest instalment loan that BNPL providers have popularised with consumers. In recent comments on the task, they said current credit scoring models are incompatible with the new loan type, and credit bureaus attempts to collect that data and incorporate it into consumers’ credit histories have fallen short thus far.

While BNPL use climbed in recent years, the slow pace of change for credit reporting in this area points to the complexity involved with fitting the burgeoning payment method into the traditional credit scoring framework.

Spokespeople for some of the biggest BNPL providers, Klarna, Afterpay and Zip, said last week their companies are not reporting transaction and account information to national credit bureaus Equifax, Experian and TransUnion.

Leslie Bender, a senior attorney with firm Eversheds Sutherland who focuses on privacy and consumer finance, expects the groundwork has been laid for BNPL data reporting and some of the standardised points have been agreed upon, but believes BNPL lenders are somewhat reluctant to get into the data furnishing business.

Since the CFPB has expressed concerns with loan stacking, or taking on multiple loans with different lenders in a short period of time, the CFPB is likely to push BNPL providers to submit data to credit reporting agencies this year, said Ed deHaan, who is a professor at the University of Washington’s Foster School of Business.

“There’s a very strong disincentive to be the first mover in this space among the BNPL providers”, because they don’t get much benefit from furnishing information and it’s costly, deHaan said in January. “That’s why regulatory mandates can help put BNPL providers on the same footing”, he said.

The credit bureaux reporting picture is similar in most other markets. This lack of data inclusion not only impacts the overall profile of a consumer, but also has ramifications for affordability models.

Summary

Whilst the BNPL market has had exponential growth over the past few years, and is still projected to grow, there are warning signs being raised about the overall risk exposure of this type of lending and its ‘fast track’ approvals process.

The Corporate Finance Institute summarises this opinion and warns that there may be turbulent times ahead for the industry.

“BNPL providers are high-tech companies with high costs to grow their platform and infrastructure. They must offer consumers and merchants compelling reasons to select their services over their competitors. Most cite “proprietary” models to underwrite unsecured credit risk for consumers and do not disclose the approval criteria.

As the industry is relatively new and underwriting is largely automated with some manual review for fraud, it is unknown if their credit quality is sufficiently compensated by the fees and interest they charge to merchants and consumers.”

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing lenders with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.