Why do lenders require a Decision Engine AND a Loan Origination System?

One of the most frequent questions that I get asked when talking about the ADEPT Decisions Platform, is “Why do I need a decision engine?” It’s a good question and the purpose of this blog is to answer this question.

Many modern Loan Origination Systems (LOS) include rudimentary structures for the risk assessment of a credit application. Simple policy rules, scorecard implementation and cut-offs enable the LOS to be a basic end-to-end solution for account origination.

In this blog, I’m going to look at the reasons why having a dedicated decision engine is crucial to lending organisations that wish to grow and rapidly adapt. Specifically, I will be using the ADEPT Decisions Platform as the comparison, as it includes all the elements that I believe are crucial to successful credit risk decisioning.

What is a Loan Origination System?

Loan Origination Systems (LOS), also known as Application Processing Systems (APS), are complex software tools that do a lot of heavy lifting. They must manage the credit application from inception to completion, including all of the following tasks:

- Control the process of each application

- Gather all of the data through application screens, internal files and third-party sources

- Queue applications for manual review if required

- Provide for document upload, storage, and retrieval

- Feed the final decision back to the applicant

- Liaise with the loan management system to set up approved accounts

As mentioned above, most LOS include the basic components for the assessment of the risk of an application.

Understandably however, given the breadth of functionality that an LOS must provide, the decisioning capability housed within a LOS is entry level, and inadequate for the needs of a modern Fintech.

Why use a dedicated Decision Engine?

Determining appropriate lending amounts and loan terms across the applicant base is the core principle of any credit granting organisation. For modern lenders, this assessment needs to be scientific, constantly evolving, regulatory compliant, and under the control of the business.

The success of the Fintech business rests in the ability to identify appropriate customers and provide them with the products and services that they need.

A Decision Engine enables business users to implement and manage all aspects of the lenders credit strategy. It also comes equipped with a large variety of tools which enable users to drive the core competencies of the FinTech business.

Using a variety of advanced scorecard types, complex mathematical calculations to determine disposable income and affordability, and simultaneous deployment of multiple competing strategies, a modern decision engine is crucial to the success of any credit granting organisation.

What components should a decision engine offer?

Below are some of the components that a well featured decision engine will provide to enable organisations to evolve credit assessment in a way that cannot be achieved with just basic LOS decisioning.

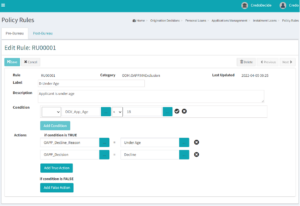

Policy Rule Implementation

Policy Rules are implemented directly into the decision engine user interface, using a comprehensive and user editable rule library. Most LOSs will enable the implementation of basic rules, but do not allow for continuous modification and deployment by business users.

This feature ensures that the credit risk team’s time is spent on the things that matter, rather than justifying the need to allocate precious IT resources for reasonably straightforward and simple changes.

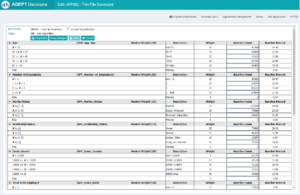

Traditional Scoring and Adverse Actions

Traditional scorecards can be easily implemented in the decision engine, and Adverse Actions can be used to provide feedback to your frontline staff regarding the reasons why an application may have been declined. Complex calculations can be configured directly in the system to derive scorecard characteristics.

Most LOSs can only implement limited versions of this type of scoring model, and often lack the ability to generate characteristics or adverse actions.

In many instances, a LOS will hard code application scorecards, thus making any scorecard changes costly and time consuming.

Non-traditional Model Implementation

One of the most important aspects of building a new model is the ultimate implementation of the model. ADEPT Decisions makes this easy by providing two key model operationalisation options. Simpler models, such as logistic regression can be implemented directly through the Scoring Function, whilst more complex Ensemble Models such as Random Forests or XGBoost Models can be implemented by calling an external service.

Most LOSs cannot implement any models other than traditional scorecards.

Complex Segmentation Tools

Decision engines enable segmentation of applications into treatment groups using visual and business user configurable tools, decision trees and matrices. These tools enable the credit risk team to perform a granular level of grouping, whilst keeping the strategies visual.

A typical LOS provides for simple score-based cut-offs for making Accept/Decline decisions and credit offer sizing. However, a LOS does not have the capacity for complex strategies that optimise approval decisions, exposure setting and pricing.

Flexible Decision Process

A good decision engine will support a flexible strategy process. Particularly in the credit originations space, the variety and sequence of decisioning can vary significantly from one lender to another, and particularly across different credit products.

In the case of ADEPT Decisions, the project team works with the client to define the sequence and type of each process step required to fully assess an application, ensuring that all decision points are included, and are in the correct sequence.

This flexible approach enables lenders to configure a wide variety of decisioning outcomes, including not only the Accept/Decline decision and loan size, but any other decisions that the credit risk team may wish to make at the same time. This could include pricing terms, maximum and minimum loan tenure, ancillary products to be offered, etc.

By adding these additional levers into the application assessment, organisations can have a far greater control over their own profitability.

A LOS typically does not have this flexibility. The decisioning that they offer is rigid and limited to simple risk assessment and loan/limit assignment.

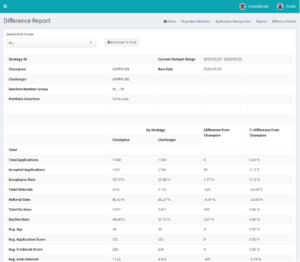

What-if Analysis

When credit risk managers and business professionals make changes to strategies, it is best practice to analyse those changes to understand what the combined impact is likely to be on the portfolio. This should be done before releasing the strategy into production.

A good decision engine will provide built-in What-if analysis capability, enabling business users to easily run historic application data through strategies to measure their expected impact. The decision engine creates side by side comparison reports between the existing and new strategies, which show the business user the expected changes in the relevant metrics.

LOSs do not typically provide this functionality, meaning that changes to strategies cannot be easily evaluated before being released. This obviously has an impact on the potential risk of rolling out a new strategy.

A/B Testing

A good decision engine provides business users with the ability to simultaneously assign multiple decision strategies to the applications. A/B testing is then conducted on a random allocation of applications in each different strategy.

ADEPT Decisions assigns a test number to each application that is received. Strategies can be assigned to percentages of the base, meaning that not only can new strategies be tested on a random selection of applications, but also that business users can select what percentage of applications each strategy receives.

Applications can be monitored by the strategy that is assigned to determine which strategy is the most profitable for the business.

This ability to A/B test different strategies is paramount to controlled credit risk management and cannot usually be found outside decision engines.

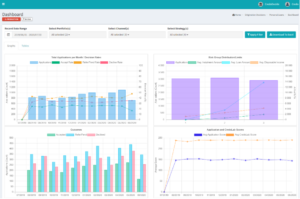

Credit Reporting and Dashboards

A decision engine should include reporting that is focused on the elements that make up the credit decision. Strategies and scorecards require specific types of reporting to enable business users to monitor their effectiveness.

For scorecards, population stability and characteristic analysis reports are crucial to monitor potential shifts in the applicant population that will cause the scores to shift.

Strategy reporting allows for deep dive analysis on the outcomes of each strategy that is assigned in production. Every element of decisioning within the strategy should be broken down for analysis, enabling the credit risk team to gain insights on the performance of their A/B tests.

A decision engine should ideally include quick reference dashboards that can be accessed by business users at any time to track credit decisioning KPIs. These dashboards make it possible for the credit team to track trends in acceptance rates, score distributions, limit allocation etc.

In ADEPT Decisions, dashboards can be filtered by date range, credit portfolio and by strategy. Filtering by strategy provides continually updating feedback on the performance of A/B Testing strategies. These tools are vital for the credit risk management team to ensure that they capitalise on changes in the market.

Typical LOS reporting tends to be operational, is related to the entire application process and does not provide a detailed view of the credit decisions being taken, or the stability of scorecards.

How does a decision engine help Fintech credit granting get to the next level?

Where a decision engine really sets itself apart from an LOS is not in the ability to implement complex strategies (although this is important), but in the ability to help the credit grantor to grow their credit strategies.

For most credit granting organisations, revenue (and by extension profitability) is directly linked to the credit risk decisions that are made. The ability to track, analyse and improve on credit strategies is key to identifying areas where the strategies are not optimal, and this enables the testing of innovative ideas for improvement.

A decent quality decision engine will provide credit grantors with the ability to simulate new strategies before deployment, and to assign multiple A/B strategies randomly, in parallel. By following this approach, lenders can test major or minor tweaks to their credit granting strategies in order to address targeted profitability levers.

Through well-constructed tests and clean A/B tests deployment, it is certainly possible to simultaneously grow revenues and reduce bad debt, and grow portfolio profitability significantly, year on year. (This is a major benefit of the ‘test and learn’ approach).

Ultimately, the question is a simple one for credit grantors. Are credit granting decisions a key driver in your business’ profitability? If so, then you owe it to the business to use the best tools to continually improve those decisions. This definitely includes using a high-quality decision engine to host your strategies.

In my next blog, I intend to look at other elements of the credit granting toolkit, to explore what value they add to the business. Bookmark this page for next month, there is plenty more to discuss!

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and credit risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing lenders with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.