How to grow and secure your customer base under the new POPIA regulations – Part 2

Optimising Existing Customers

Article 1 in this series focused on new customers acquisition within the context of the new POPIA/GDPR regulations. This second article addresses how companies should optimise their marketing strategies for their existing customers.

In my experience as a marketer, I have realised that most companies have one specific problem in common. They believe that their offering, service, or product is unique to what is offered by their competitors. The sad thing is that they are all mistaken. So let us say there is the odd chance of your offering being unique. How are you planning to tell the world about it or ensure that your existing customers feel that they are getting the best value for their money?

The first thing you must do is create a well thought out marketing strategy. This article does not contain the answers to all the challenges that we are facing but aims to cover some of the solutions available to optimise your existing customer base and increase your company’s return on investment (ROI).

There are six steps that should be followed to successfully grow and retain your existing customer base. Each step will be discussed in more detail below.

- Reduce attrition/churn

- Identify needs by segment

- Optimise customer loyalty drivers

- Maximise spend and share of wallet

- Create a customer-focused value proposition

- Measure and manage the total customer experience

Reduce attrition/churn

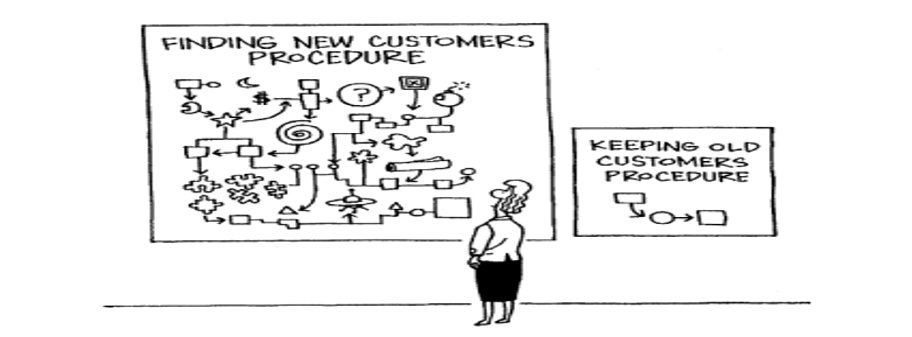

Did you know that it costs five times as much to attract a new customer, than it does to keep an existing one? The first rule of any business is to retain customers and build a loyal relationship with them. This approach avoids the cost of continually having to attract new customers to maintain the same base (incurring high acquisition costs).

It is recognised that the longer a customer stays with a company, the more that customer is worth to the business. Long-term customers buy more, require less of a company’s time, are less sensitive to price and in certain instances bring in new customers/referrals (family and friends).

It is important to have a proper understanding of your customer life cycle and to ensure that you pro-actively interact with your customers throughout this life cycle.

To reduce attrition/churn, you must Listen, Analyse and Act.

Listen when your customers post comments or reviews on social media platforms. Listen when they have complaints or compliments. Use your customer services department optimally to retain or win back dissatisfied customers.

Analyse your customer base and make use of predictive modelling (attrition models and trigger-based models are some examples) to identify customers who are more likely to close their accounts or move to a competitor.

Segment your customer base e.g., identifying high value customers, and build a strong value proposition around them. Build trigger-based models (these models are based on pre-determined events, for example credit bureau enquiries by a competitor) if you have access to credit bureau data. Or use other analytical tools (e.g., Google Analytics) to know when your customers are shopping around and act rapidly with a relevant offering.

Act upon these predictions or triggers and send focused marketing messages and offerings through your customers’ preferred communication channel.

Identify needs by segment

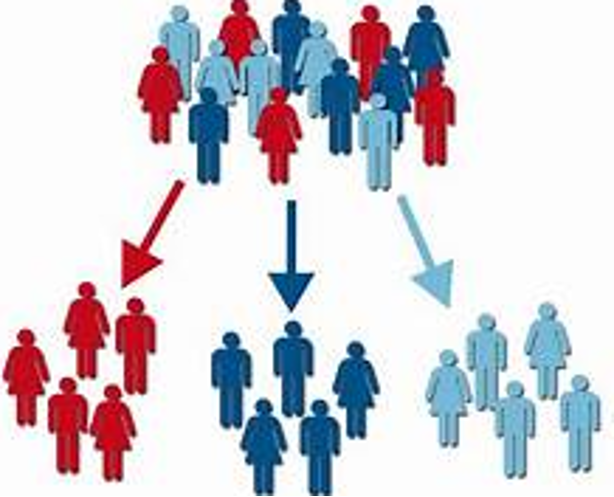

Segmentation is a well-known and widely used marketing practice to identify customers who are similar in terms of specific criteria.

There are many ways to segment your customer base, i.e., geographical segmentation, lifestyle segmentation, life-stage segmentation, value-based segmentation, and behavioural segmentation to mention just a few.

It is best practice to tailor your product offerings and marketing messages according to these various segments and communicate with each customer through their preferred communications channel.

Another tool widely used is Next-Best-Product models. These models predict which product to offer your existing customers and can be used for upselling or cross-selling to your base. They are based either on the customer life cycle or life-stage or a logical product expansion analysis. Examples would be offering credit life Insurance to existing loans customers or value-added services to existing insurance customers.

Optimise customer loyalty drivers

It is important to understand what drives customer loyalty and retention within your business.

Most companies make use of surveys to understand the drivers of customer loyalty. Customers can then be allocated into separate groups. For example, committed customers, fence sitters and customers who are vulnerable (price sensitive, service sensitive or brand sensitive).

Design your loyalty strategies to allocate resources, marketing budget, offerings and effort according to these different groups. Loyal customers lead to referrals and thereby automatically growing your customer base without additional acquisition costs.

Maximise spend and share of wallet

To further optimise your existing customer base, it is crucial to understand what ‘share of wallet’ means.

Share of wallet is the amount an existing customer spends on a particular product or service with you, rather than buying similar products and services from competitors. To grow the share of wallet, companies should aim to introduce complementary products or value-added services to generate as much revenue as possible from their existing customer base.

In the credit risk industry, it is customary practice to make use of dual matrices to determine the revolving credit facility to be assigned to a customer (allocation by a combination of risk and affordability).

The challenge, once the optimal facility has been allocated, is to ensure that the customer uses as much of that facility as possible. By using relevant marketing campaigns, special and relevant offerings and promotions, companies can increase the spend of their existing customers and thereby increase share of wallet, add revenue, improve customer retention, customer satisfaction and ultimately customer and brand loyalty.

Create a customer-focused value proposition

Customise your value propositions according to different audiences or segments. Remember that one size does NOT fit all.

Value propositions should be Specific, Problem-focused, and Exclusive.

- What are the specific benefits that your target segment will receive? It is important to have a clear marketing message showcasing the benefits of your value proposition.

- How will your product offering solve the customer’s needs? Make sure that you are relevant and address your customer’s needs.

- How is your product offering both desirable and exclusive? How does it compare to your competitors? Highlight the characteristics that differentiate you from other products or competitors.

Measure and manage the total customer experience

Optimising your existing customer base does not only mean attracting, retaining and growing your base but also having a holistic view of the total experience of the customer when dealing with your company.

A customers perception of your products and services is created by a set of experiences with your company. This goes from brand promise to operating performance, quality and relevance of your products and services and after-sale customer service.

These perceptions and experiences drive customer behaviour and impact the likelihood of churning or spending their money elsewhere. Regular customer focus groups and surveys are tools that can assist to identify areas for improvement throughout the total customer experience cycle.

Products, value propositions and marketing messages should be regularly reviewed and re-designed, if necessary, to ensure that you stay relevant and top of mind to your customers.

Direct marketing to your existing customer base and what POPIA has to say about it

Now that we have discussed the steps to grow and retain your existing customer base it is also extremely important to understand how to communicate with your existing customers to ensure that your company remains within the regulations of the POPIA Act. To quickly recap from Part I on what POPIA is all about:

“The creation of the Protection of Personal Information Act in South Africa (also known as POPIA) began as early as 2013 but it took a long time to formulate. One of the many reasons that it took so long to finalise was the question if the South African Government should also comply with the Act (it was finally decided that the Government should also comply with the Act). After many debates and changes to the Act, it officially came into effect on 1 July 2020 with a grace period of one year. Companies had until 1 July 2021 to ensure that they had the necessary processes and procedures in place to adhere to this Act. The POPIA Act covers both consumer communications as well as B2B (Business-to-Business) communications.”

The first and obvious question is do I need consent to market to my existing customer base? The answer in general is NO, if you can say YES to the following questions:

- Did I get consent from my customers to market additional products to them at the time of sale?

- Do my customers know exactly who I am as a company sending marketing messages?

- Does the company offer the same or comparable products to the products or services initially sold?

- Do I give my customers the option to opt-out or unsubscribe from any marketing messages or newsletters?

If your answers to the above four questions are YES, then you do not need to get consent from your customers and you can send direct marketing messages or conduct telemarketing to your existing base. There is no need to re-consent your existing customer base as it would ultimately result in a loss of marketable customers and the opportunity to upsell or cross-sell to them.

With POPIA in play it is now more important than ever to optimise your existing customer base, as once you have lost a customer it will be far more difficult (even impossible) to attract that customer through direct marketing campaigns in future.

The secret to retaining your existing customer then lies in being relevant, top of mind, channel specific, quality driven and service oriented.

About the Author

Ulandi Steenkamp is a Client Solutions Consultant at ADEPT Decisions

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing lenders with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.