What does the growth in mobile lending mean for banks

In the previous article, ‘The Rise of Mobile Lending in Africa – Part 1’, I described the rapid growth of mobile lending, specifically amongst the unbanked populations in Africa. I discussed how the mobile operators were able to grant credit in an environment in which the traditional banks were not prepared to operate, and that they were able to do so for several reasons:

- They are able to use their own infrastructure for credit applications, disbursals, and payments.

- Due to the lack of operational overhead, they are able to process and offer high volumes of extremely low value credit products.

- As the mobile wallet is a transactional account, mobile providers are able to sweep funds that come into the account in order to settle past due loans.

- Minimise credit losses by offering credit purchases of airtime, which has a significant retail margin.

Mobile lenders are also able to perform risk assessment on the credit unaware population, by using performance data on pre-paid phones and mobile wallets to build risk prediction models. Coupling this with high throughput flexible decision engines, they are able to test and learn the optimal strategies for mobile lending at an accelerated pace.

So where does this leave lending from traditional banks?

Mobile wallets have already started eating into the banks’ transactional portfolios, as people get used to using their phones to conduct the majority of their financial transactions. It is no longer only the unbanked that are making use of the mobile wallets. Banked customers have now also discovered the convenience of using mobile wallets and are conducting a lot of their financial transactions through them.

On the lending side, banks are limited in terms of the credit products that they can offer, particularly to the unbanked or underbanked populations. Bricks and mortar banks have high overheads that need to be considered when offering products, and predominantly interest-based revenue models mean that portfolios of low value loans running off a high-cost base are often more expensive to grant and manage than the revenue that they generate.

This is the main reason a significant percentage of the African population has not had access to credit products from banks. Their income is too low and not stable enough to fit into the traditional banking suite.

So how can banks move into the market that is currently controlled by the mobile phone operators and their mobile wallet platforms?

There are a number of prerequisites that banks need in order to compete:

- Predictive data which can be used to assess non-traditional customers for credit.

- Strong and disciplined analytics and modelling skills and tools in order to track, measure and react to market shifts.

- Credit decisioning tools that can be rapidly changed to deploy and manage the outcomes of the analytics.

- Everything from model development through to application decisioning must be automated as much as possible to minimise costs and speed up the turnaround of the application.

- Streamlined cost structures that move all non-attributable costs away from non-traditional loan portfolios

Traditionally, banks have primarily made use of an application form and credit related data in order to assess the credit worthiness of applicants. It makes sense that an individual’s previous credit repayment behaviour will predict their future behaviour. However, this creates an environment where an applicant needs to already have well managed credit when applying for a new credit product. (This is the conundrum where you need to have credit before you are granted credit!).

In most markets, consumers are aware of this, and usually start their credit journey purchasing goods on credit from a retailer, as they know that they are more likely to qualify there than at a bank. (In the USA, the traditional means to establish credit was to open up an account with an oil company, for use at the service stations).

In Africa and Europe, retailers can usually accept customers with a much higher risk profile than banks, as their credit is subsidised by the retail margin of the goods being sold. This works in much the same way that mobile operators can offer airtime advances to higher risk customers. If the loan does not get repaid, the operator has only lost the wholesale costs that they incurred providing the airtime.

What data is available to assess consumer credit risk?

Another challenge for the banks is that the traditional models that are deployed are based on credit performance with themselves, or from other providers that contribute to the credit bureaux. The pre-paid telco account and mobile wallet usage data that the mobile operators use to model risk on new to credit customers is not available to the banks.

Additionally, all of the data the mobile lenders are gathering on their customers’ loan performance is also proprietary, as mobile lenders are not typically affiliated with the credit bureaux.

So, if banks cannot offer speculative small loans profitably, and they do not have the data that they would normally use to assess risk for the granting of larger loans, then what can they do?

One solution that the banks can examine is development of risk predictive models that do not use the traditional data that they have relied on in the past. They can still have models based on the typical application form information, but something else is needed in order to provide an accurate picture of the customer’s credit worthiness.

Since the start of the digital age, our interaction with devices has created an exponential increase in the number of data points that organisations have access to (and of course sell), and many of these data points could prove extremely predictive of the way that consumers will conduct their affairs. This is not a limited set; in fact, the amount of data that we are creating is growing at extraordinary rates.

Below are a few statistics that may better describe this picture:

- 1.7MB of data was created every second by every person during 2020

(Source: Domo) - In the last two years alone, 90% of the world’s data has been created

(Source: IORG) - Humans produce 2.5 quintillion bytes of data every day

(Source: Social Media Today) - 463 exabytes of data will be generated each day by humans by 2025

(Source: Raconteur) - 350 million photos are uploaded to Facebook each day

(Source: Omni Core Agency) - By the end of 2020, 44 zettabytes made up the entire digital universe

(Source: Raconteur) - Every day, 306.4 billion emails are sent, and 500 million Tweets are made

(Source: Internet Live Stats)

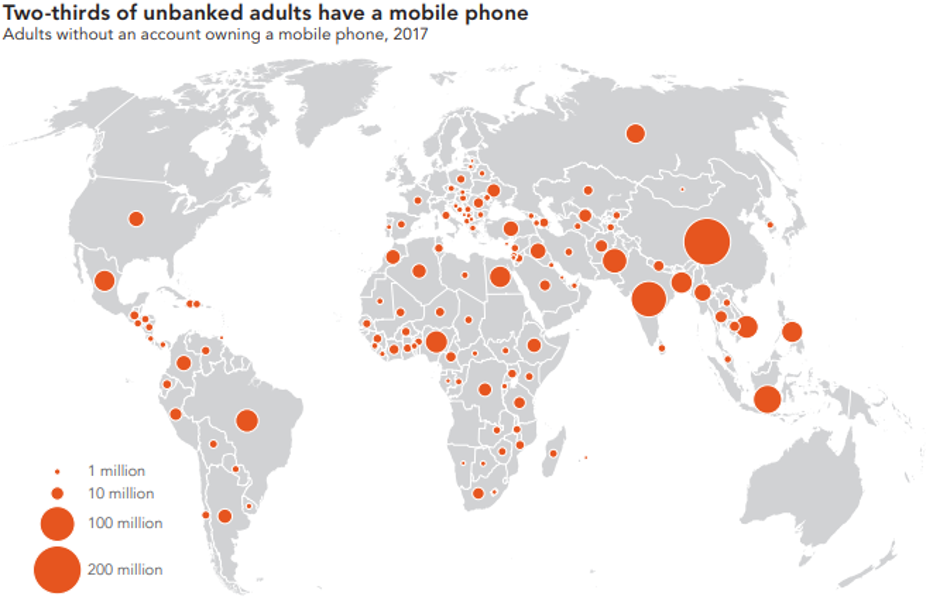

While the sheer size of some of these numbers is staggering in and of itself, it is also important to note that the majority of this data is created through mobile phones. This widely accessible technology is growing in global market penetration year after year. The below diagram is sourced from the Gallup World Poll in 2017.

Worldwide, two thirds of the unbanked population have mobile phones. By 2022, this statistic is probably over 70%. All of these individuals are creating datapoints that can be used to model their behaviour, despite not participating in traditional banking platforms and thus the financial data upon which traditional models were built.

And unlike the mobile wallet data, access to this information is not limited to the mobile lenders but is aggregated by app providers and sold on for third party organisations to use.

How to get the most value out of the data

Coupled with the rise in data points, the uptake of machine learning models has created a world where predictive models can be built and deployed rapidly, using broad data ranges of data that can easily be updated and changed on a regular basis. This creates an environment where an experienced data analytics team, given access to large sets of data and tools to explore it, can develop and retrain risk predicting models on a regular basis. This enables traditional banks to grant credit into markets that they have been previously unable to.

Should the banks not have the capability to gather and analyse these huge datasets in-house, there are now service providers that are developing and selling scores built on non-traditional data. In fact, this is probably a good starting point, as acquiring all of the data to use for analysis, the tools to build the models, and the analytics team could be an expensive undertaking.

A pre-created model, validated on the bank’s applicant population, could add a substantial portion of the value, and at a considerably lower cost. The cost of the provided scores can be budgeted for as part of the fixed costs allocated to the portfolio.

Alternative data models are by no means a silver bullet, and they will not work for all populations (for example, a high level of smart phone penetration is crucial to getting good coverage), but they do provide an opportunity for banks to compete with the mobile lenders.

As always, and as I mention in all of my articles, strong decisioning tools should be in place in order to make the most out of the investment in alternative data models. Structured testing is crucial to maximise the learnings that are taken from the new market. Organisations can get the best of both worlds – the models evolve over time as the data changes, and the strategies evolve as we learn how best to apply the risk and propensity scores.

Finally, banks need to consider the products that they offer, and which ones are applicable to this market. The traditional banking suite of products is not necessarily going to be applicable to these customers. New, fit for purpose mobile lending products need to be offered.

Short term, low value loans should be the starting point, as the per customer exposure is limited, and the loan performance can be assessed very quickly. This will enable the banks to rapidly gather lending performance data, which can then be used to gradually drive higher value and longer-term lending products in the future.

About the Author

Jarrod McElhinney is a Client Solutions Manager at ADEPT Decisions.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing lenders with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.