Stories & Learnings from a Career in Credit Risk, Part 2

Introduction

Last December I wrote a light-hearted piece about some of the funny or strange things I have encountered in my many years in the credit risk industry. I also provided some of the learnings gained from these experiences.

The article proved to be very popular with our readers, so I decided to dedicate the last two articles of this year to more of these stories.

Here are two stories, from different parts of the world, and for obvious reasons all names and institutions have been anonymised.

“Storytelling is our obligation to the next generation. If all we are doing is marketing, we are doing a disservice, and not only to our profession, but to our children, and their children. Give something of meaning to your audience by inspiring, engaging, and educating them with story. Stop marketing. Start storytelling.”

Laura Holloway, Founder & Chief of The Storyteller Agency.

The Limit Increase Lottery Winner

We had implemented an automated limits increase and decrease strategy at a large UK bank, and it had been in place for approximately six months. This was a particularly sophisticated client and so I used to monitor the results frequently to pre-empt any queries that would arise.

The limits strategy increased accounts every six months, driven by card usage and everything seemed to be working fine and according to the expected results. Limit increases and decreases tend to occur at cycle billing, which is when I used to double check the numbers.

Imagine my surprise when one billing cycle I noticed that the average new limits and amount increased were significantly higher than expected. Alarm bells went off and I spent the rest of the day reviewing the strategy and in particular checking if any new changes had been made. The strategy had no obvious errors and had not been changed.

The next day I requested a report of all the accounts that had been increased by the strategy and spent the whole day running through new limits and checking the increase scenarios. Nothing untoward was detected.

The third day, and at my wits end, I requested a report of all accounts that had been manually increased during the billing cycle. And there it was! The client had a policy of increasing limits manually for a maximum of GBP 500, if a customer called in with a limit request. However, there was an account that had been increased by GBP 50,000,000 which stood out in flashing lights on the reports.

A quick call was made to the client and there were red faces all around as they hadn’t picked this up. The limit was instantly reduced to normal before the customer had received their printed statement and luckily, they had not noticed the mistake.

There was an internal investigation, and it appears that this mistake was made due to a clerical error. The negative publicity could have been horrendous. It also doesn’t bear thinking about what if the customer had gone on a spending spree like a lottery winner!

Learnings

- Review reports daily to spot outliers and anything unexpected.

- Clients need to ensure that there are fail-safes in their processing systems to manage the risks of manual mistakes, e.g. maximum manual limit increase amounts.

How Not to Avoid a Team Strike

This story occurred in the collections department of a client in South Africa. South Africa is an emerging market, but has a highly sophisticated credit risk management environment, covering decisioning software, predictive diallers, credit bureaux, direct debits (known locally as ‘debit orders) and all of the other systems that can be found in established credit markets.

We implemented first generation account management strategies and anyone who has ever worked in decisioning knows that the most difficult strategies to design and implement are for collections management. This is because whilst the strategy automates actions, it is collectors and dialler managers who provide the execution, which leaves a lot of scope for ‘operational negation.’

Operational negation is a term which is feared and loathed by all decisioning consultants worldwide and occurs when individuals such as collectors or customer service agents knowingly or unknowingly affect the decisioning strategy objectives.

The strategies had been designed very carefully and expected collections volumes were estimated to ensure that the collectors were neither under nor overworked.

The very first month of a brand new collections strategy requires a lot of monitoring to ensure that everything is working as planned and results are in accordance with reasonable expectations. The first month went well and we all felt relieved and expected the champion/challenger strategy results to start showing significant differences by the third month, which is typical for collections, due to the impact of forward roll rates.

By month two the new challenger strategy had bedded down and started to show clear signs of improvement over the champion strategy, which mirrored the client’s legacy business as usual.

For month three, we had the shock of our lives when the challenger started to show results that were worse than the champion! We spent that entire month going through strategy reviews and trying to find any obvious errors or oversights. We couldn’t find anything.

By month four, the client’s credit risk management team was under a lot of pressure from senior management due to the lower than expected results. It was decided we would go back on site to investigate first hand, as it had to be something occurring in the collections department, outside of the realm of the risk management team.

We spent a week onsite reviewing the challenger strategy results which by then were significantly trailing the business as usual strategy and a groundswell of criticism had started with it being mooted that the strategies weren’t working and needed to be backed out.

Halfway through the onsite investigation we reviewed the predictive dialler reports and were shocked to see that the accounts which were supposed to not be worked (low risk accounts which would pay down of their own accord) were being worked intensively and the high risk accounts which were supposed to be worked daily, were not being worked at all.

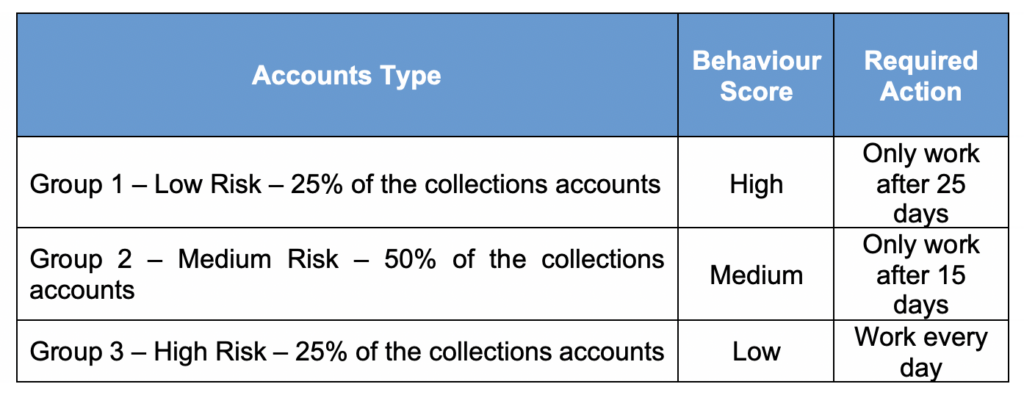

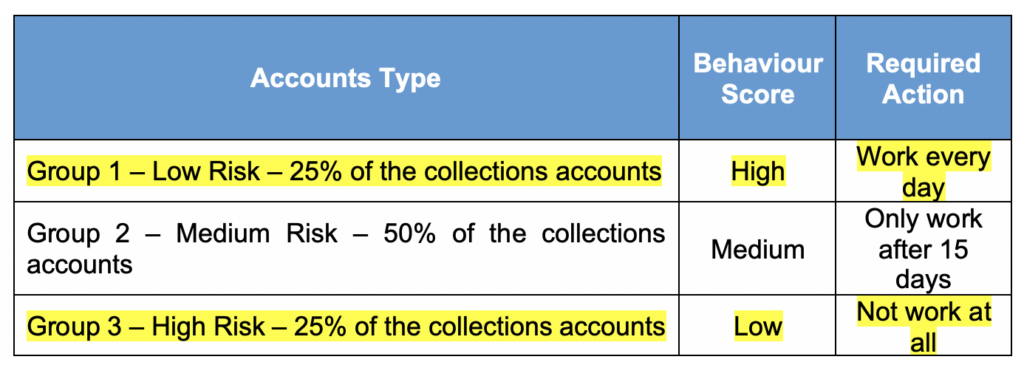

This can be better explained via these two tables, with the client changes highlighted in yellow:

What the ‘centre and tilt’ strategy originally looked like:

What the client did:

We held an emergency meeting with the predictive dialler team and walked through the dialler reports with them. They readily admitted that the collectors hated working the high risk accounts and loved working the low risk accounts, as these were much nicer customers and paid up easily, which meant they made higher commissions!

By the second month, the staff had enough and so threatened to go on strike if the situation wasn’t changed back to the pre-champion/challenger status quo. Faced by a call centre strike, the predictive dialler manager unilaterally decided to switch the calling queues so that the agents only worked the low and medium risk accounts. Everyone was then happy again and the threatened strike was averted!

Sometimes when you hear things as incredulous as this, you can actually understand the ‘logic’ that was used to implement one of the greatest examples of operational negation I ever came across!

Needless the say, the calling priorities of the collections queues were reverted back to the intended sequence and the client had to invest in a lot more time educating the dialler management team and also the collectors as to what it was, they were trying to achieve.

Within two months we started to see results which made sense and by the end of the testing period the challenger strategy clearly beat the champion business as usual strategy hands own. Unfortunately due to this classic example of operational negation, the client lost a number of months of business benefits, and we had a lot of sleepless nights!

Learnings

- Never underestimate the negative effect that operational negation can produce.

- Whenever implementing substantial changes within a department, staff buy-in, training and communication is of paramount importance.

- Never underestimate the time required to change the culture and modus operandi of a bureaucracy. Making changes in a client’s operations can sometimes be akin to changing the course of an ocean liner.

- Client’s risk, collections and dialler teams often work in ‘silos,’ in different buildings and even in different cities. The importance of all three teams working closely together can never be reiterated enough.

Summary

If you enjoyed these stories, please let me know and I can always create future articles with additional tales, of which there is no shortage of!

As mentioned in the introduction, and to paraphrase the disclaimer always used in American TV series, “…no identification with actual persons (living or deceased), places, buildings, and products is intended or should be inferred.”

However, I have added learnings to each story, and these should be taken on board by the reader, as they have helped me greatly in this industry over the years.

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and credit risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing fintechs with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.