What is a Decision Engine?

Part 1 – What a Decision Engine is NOT!

Introduction

I always thought that the definition of a Decision Engine was very straightforward. It is software that makes a decision.

A British advertising industry created a memorable catch phrase describing this kind of product:

“It does exactly what it says on the tin” was originally an advertising slogan in the United Kingdom, which then became a common idiomatic phrase in that country. It colloquially means that the name of something is an accurate description of its qualities. It is akin to the previously existing phrases “by name and by nature” and “it lives up to its name”.

The idea of the phrase was to emphasise that the company’s products would act and last for the amount of time exactly as described on the tin can. The word tin is generally used even when the product is sold in a different type of container, although box is also sometimes used. The expression soon entered common usage in the UK.”

Despite the straight forward name of this software product, if you ask three people “what is a Decision Engine?,” you will probably get at least five different responses. For a product that has such a straightforward and descriptive name, there is a lot of confusion and misperceptions around as to what a Decision Engine actually is and what it does.

In this two part series, describing what we believe a Decision Engine to be, we will examine the question from opposite perspectives:

- Part 1 – what a Decision Engine is not.

- Part 2 – what a Decision Engine truly is.

Please note that for this series of articles, we are only examining a Credit Decision Engine, focusing on an Originations use case.

What a Decision Engine is NOT

It does seem a strange way to go about describing what a product is, by first examining what it is not! This approach is based on many years of responding to Requests for Proposals (RFPs) which seem to have become increasingly outlandish and unrealistic with their expectations as to what constitutes a Decision Engine.

As time has gone on, expectations of a Decision Engine’s functionality have grown and grown!

Application Capture

This is probably the most misunderstood aspect of a Decision Engine. All of the customers’ application information needs to be captured via screens in the clients’ LOS or LMS and then passed to the Decision Engine via an API.

A Decision Engine does not capture data and does not provide application processing screens for the clients’ employees. These are all functions of an LOS.

Workflow

Workflow is the process that is managed by a client’s Loan Originations System (LOS) and Loans Management System (LMS).

These are complex software systems that perform a lot of heavy lifting. They must manage the credit application from inception to completion, including all of the following tasks:

- Control the process of each application

- Gather all of the data through application screens, internal files and third-party sources

- Queue applications for manual review if required

- Provide for document upload, storage, and retrieval

- Feed the final decision back to the applicant

- Liaise with the loan management system to set up approved accounts

A Decision Engine works hand-in-glove with an LOS and/or an LMS but does not include the workflow component. Workflow clearly belongs outside of a Decision Engine as a separate software component.

There are many LOS and LMS solutions as well as workflow software that are available to clients.

Client and Fraud Databases

A Decision Engine will record all of the decisions that have been made on an applicant but is not a replacement for a client or fraud database, which are external components.

Scorecard Development Software

A Decision Engine will calculate scores based on application, credit bureau and alternative data. However, a Decision Engine is not the software that is used to create application scorecards.

There are many scorecard development software packages that are available to clients.

Orchestration

A Decision Engine can work with unlimited data sets from multiple sources. However the management of the data and is performed by a separate Orchestration Layer.

Orchestration is also where data formatting occurs.

“An orchestration layer steps in when multiple API services need to be coordinated. As a result, it adds the ability to manage data formatting between separate services. Especially, where requests and responses need to be split, merged or routed.”

Document Capture and Scanning

These two functions are performed by separate and external systems. These are not the roles of a Decision Engine.

Biometrics

This is external to a Decision Engine and a biometrics system would typically interface with an LOS.

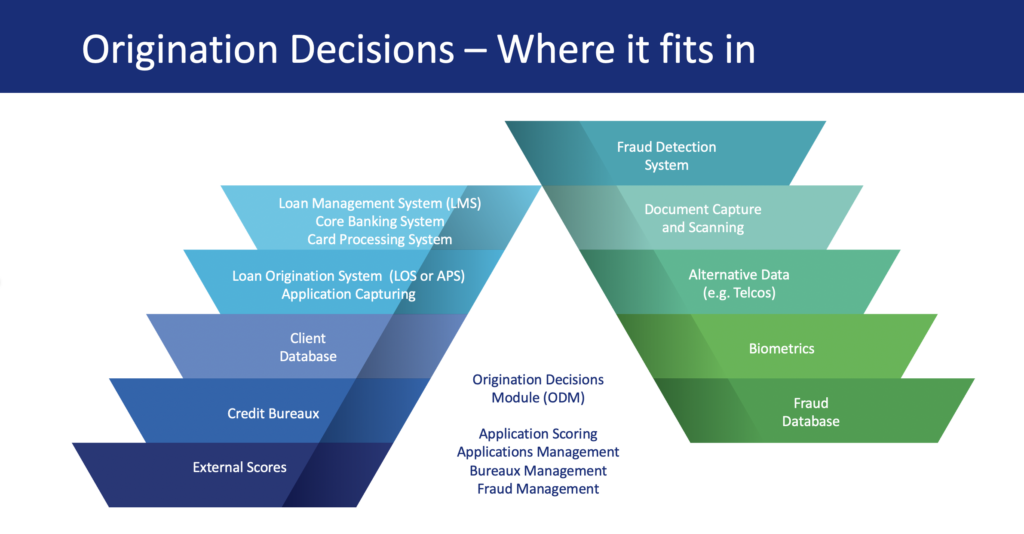

Where an Originations Decision Engine Fits In:

Summary

As previously mentioned, it does seem ‘about face’ to start the description of a Decision Engine by listing what it is not. This approach is based on clients’ ever-increasing requirements, which is understandable in a business environment that is forever driven by the search for value.

However, it is also important to consider that credit systems are by nature highly specialist and by trying to force one system to be ‘all singing and all dancing’ this approach will result in decreased overall quality of decisions and processes. The phrase “Jack of all trades and master of none” springs to mind.

I will never forget a meeting years ago, where a colleague, clearly exasperated by the long list of functionality that a prospect was trying to ‘shoe horn’ into the Decision Engine, finally stated “the Decision Engine will not cook your breakfast!”

This is a phrase that should be considered by both vendors and clients alike.

Now that we have described what a Decision Engine is not, in the next article in this two part series, we will examine the components and functionality of a true Decision Engine.

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and credit risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing fintechs with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.