With over 10 years of credit risk management solutions and 5 billion decisions generated across a wide range of credit products, we have proven that our success becomes our clients’ success.

Who we are

Why we are different

What we do

Case Studies

As part of the integration project, ADEPT Decisions migrated 20+ years of accumulated credit decisioning policies and rules from the old code-based system into our no-code configurable environment. As part of the engagement we added increased flexibility and A/B testing capabilities to each component.

The ADP Decision Engine is now governing all credit decisioning for new customers, upgrades and contract additions for existing customers. Since going live, the client’s credit risk management team has been able to rapidly implement new scorecards and launch new products. In addition, they develop new and more profitable champion-challenger strategies faster and with no intervention required from the internal IT team.

“…faster and with no intervention required from the internal IT team”

“…enabled the business to leap forward in their credit assessment and management capabilities”

A further challenge facing this client was that they operated two businesses under one umbrella – a household retail business and a personal finance business. The businesses operated on entirely independent technology stacks and used completely different new accounts channels and credit risk management decisioning processes.

ADEPT Decisions configured decisioning solutions for both business units, catering to the diverse requirements of each operation. Both divisions were provided with decision engine capabilities to analyse strategy performance and run out of the box A/B testing. The ADP Decision Engine enabled the business to leap forward in their credit assessment and credit risk management capabilities, with multiple champion-challenger strategy revisions run and evaluated at the same time.

This telco required a robust and cloud-based decision engine for managing mobile wallet credit applications across 16 countries. Each of these countries operate as an independent business, thus different credit risk management strategy and scorecard configurations were required for each operating company.

To provide maximum flexibility, we configured the solution in such a way that the application request is routed into the ADP Decision Engine from the customer’s mobile device with minimal information attached. The ADEPT Decisions Platform integrates with the customer information repository for each operating company to retrieve credit decisioning information for the customer.

By creating each company as an independent subscriber to the system, credit risk management strategies and scorecards are separated, enabling authorised users to log into specific configurations that they control. By keeping the template for each of the subscribers aligned, our mobile financial services client can rapidly roll-out decisioning to new countries. This enables operating companies to be rapidly launched as new subscribers in the system with template structures and credit risk management strategies copied from existing subscribers.

The ADP Decision Engine is highly scalable and has processed over 100,000 applications a day from one of the first operating companies.

“…the solution is highly scalable and has processed over 100,000 applications a day from one of the first operating companies”

Our Team

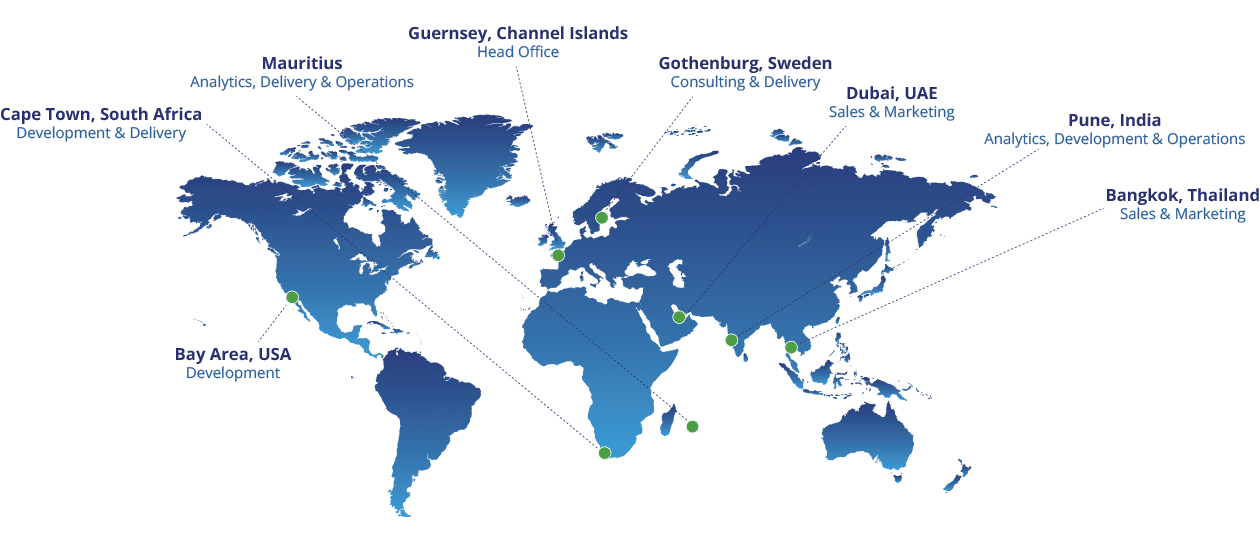

Our professionals have many years of experience in all aspects of credit risk management, combining industry expertise with a deep understanding of what constitutes global best practice.

In addition, our team has an established track record of successful implementations of decision engines, advanced analytics, credit risk management strategies and training at a wide range of clients based all over the world.

We have a diverse team of highly experienced professionals based in multiple global locations:

Our Partners

We have created a team of partners to enhance our fintech lending toolkit for our clients.

What clients are saying