ADEPT Decisions Platform – Life Cycle Customer Decisioning

The ADP Decision Engine provides end-to-end complete customer life cycle decisioning.

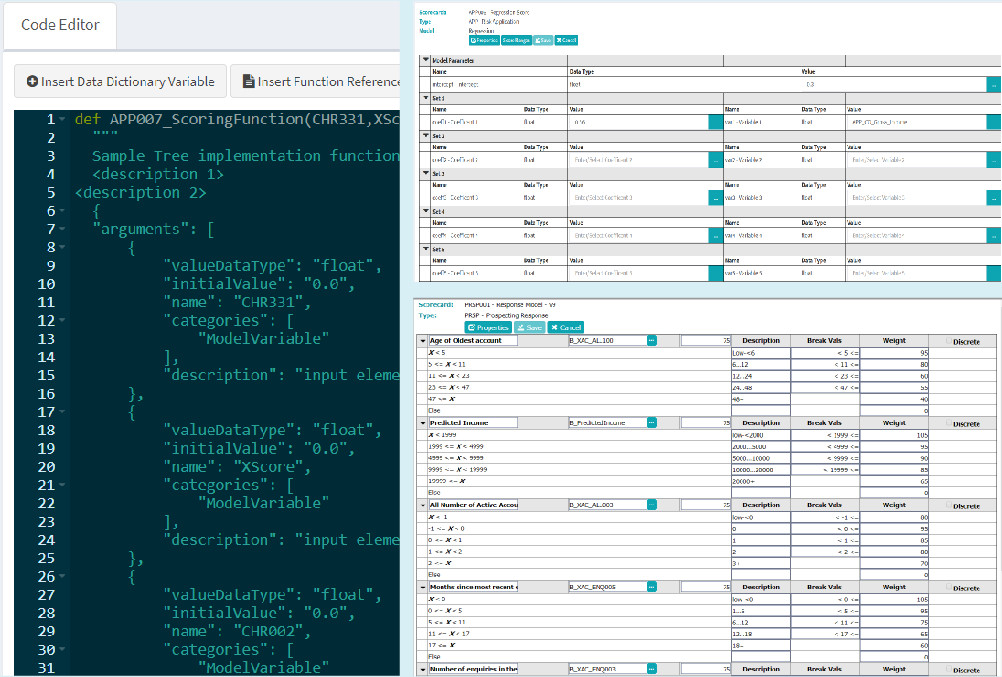

Example Behaviour Scorecard

Behaviour Scoring Management

- ANY data item that is contained within the data dictionary is available for use as a characteristic within any scorecard.

- There is no limit to the number of scores that can be calculated within the Scorecard Editor.

- Traditional scorecards, regression models and AI models can be added directly into the User Interface or imported from PMML.

- Business users can also use the Function Editor to generate new characteristics from raw data contained in the data dictionary.

Pre-Delinquency Management

- Prevent accounts rolling into delinquency

- Reduce bad debt and collections costs

- Focus on prevention creates significant collections benefits

Delinquency Management

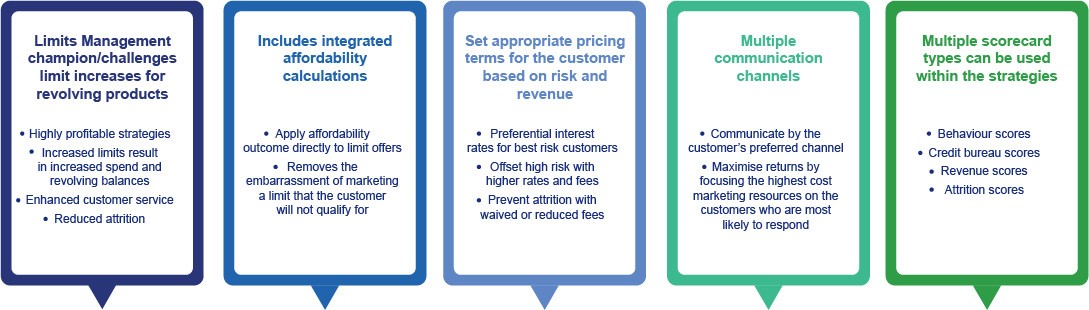

Limits & Pricing Management

Communications Management

Enables the marketing and risk departments to work closely together to maximise customer decisioning, profitability and proactively reduce attrition/churn

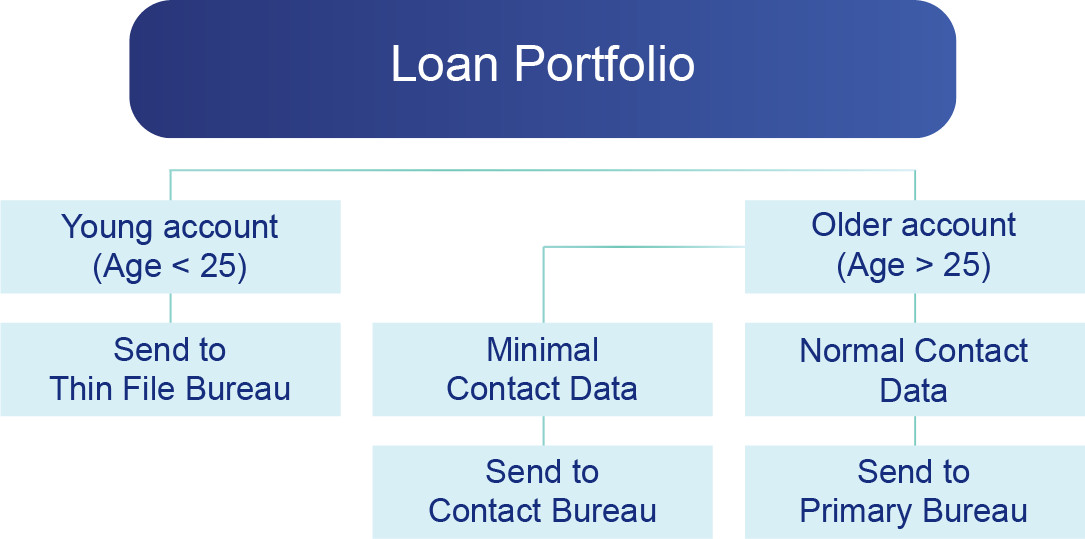

Bureaux Management

- Enables subscribers to champion/challenge different credit bureaux to determine which provides the best data for their portfolio.

- Subscribers can also use different bureaux for different segments of the population.

- e.g. younger accounts could be sent to a credit bureau which has the best thin file information.

- Primary and secondary bureaux can also be assigned, in case the primary bureau is unresponsive, and failover is required.

- Bureaux Management controls the calls to all bureaux and interprets the return data for use in accounts decisioning.

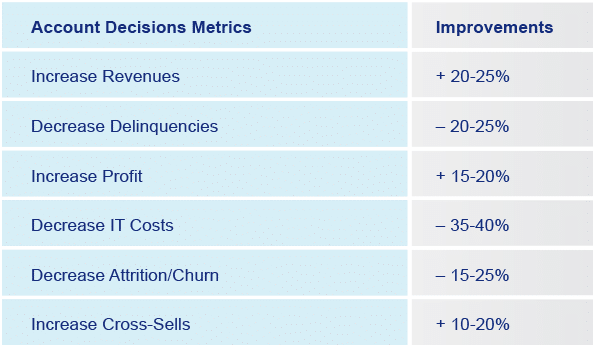

Typical Benefits of Account Decisions Strategies

The ADEPT Decision Engine will typically deliver these benefits which are beyond what a standard Loan Management System can provide.

A Loan Management System will be able to perform some basic scoring and policy rules setting.

Only a decision engine has the true flexibility and functionality to perform complex calculations and make granular assessments. These maximise a portfolio’s results by optimising all performance metrics.

The ADEPT Decision Engine components are all integrated to work seamlessly to run sophisticated A/B tests that will maximise your portfolio’s customer decisioning strategies and profitability.

ADEPT Decision Engine Benefits

Decision Engine Benefits