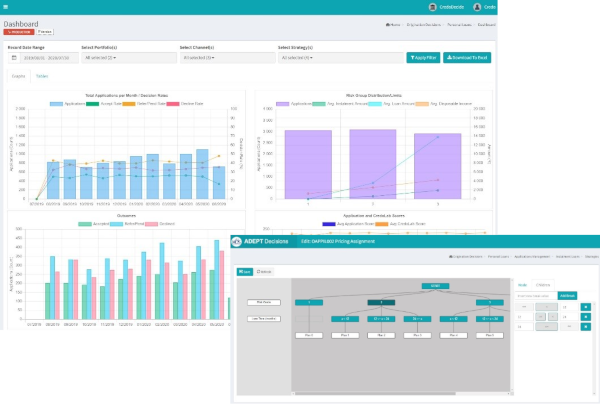

The ADEPT Decisioning Software supports both Machine Learning and traditional scoring models. These enable best practice A/B strategy testing which will continually optimise your credit portfolios.

Why do you need a dedicated Decision Engine?

Determining whether to accept or decline, and set appropriate risk-based limits, terms and conditions for all credit applications is the core function of any credit grantor. For modern lenders, credit assessment needs to be scientific, constantly evolving, and under the direct control of the credit risk team using Decisioning Software.

The success of any lending business rests in the ability to identify appropriate customers and provide them with the products and services that they need, all within a reasonable timeframe.

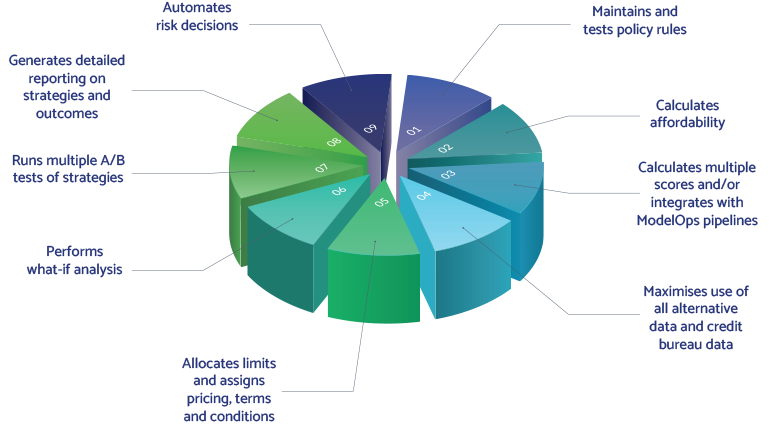

A Decision Engine enables business users to rapidly implement and manage all aspects of the lenders credit strategy. A Decision Engine comes equipped with a wide variety of tools which enable users to drive the core competencies of the lending business.

- Efficiency: A decision engine automates the credit assessment process, allowing lenders to evaluate applications quickly and efficiently. This reduces the time taken to make lending decisions.

- Consistency: Automated decision-making ensures that all applications are assessed using the same criteria, leading to more consistent and fair outcomes for borrowers.

- Risk Assessment: Decision engines utilise advanced algorithms and data analytics to evaluate the creditworthiness of applicants, helping lenders to better manage risk and minimise defaults.

- Data Integration: APIs can integrate various data sources, including credit scores, employment history, and financial behaviour, providing a comprehensive view of an applicant’s financial situation.

- Scalability: As a lender grows, a decision engine can easily scale to handle increased application volumes without a proportional increase in manual processing resources.

- Regulatory Compliance: Decision engines can help ensure compliance with lending regulations by maintaining detailed records of decision-making processes and criteria used.

- Customisation: Lenders can tailor decision engines to their specific risk models and lending criteria, allowing for more customised lending approaches.

Overall, a decision engine enhances the lending process by making it faster, more reliable, and more data-driven, which improves the lenders competitive advantage.

Using a variety of advanced scorecard types, complex calculations to determine disposable income and affordability, and simultaneous deployment of multiple competing strategies, all make modern decisioning software crucial to the success of any lender.

What is the ADEPT Decisions Platform?