Stories & Learnings from a Career in Credit Risk Part 3

Introduction

Last December I wrote a light-hearted piece about some of the funny or strange things I have encountered in my many years in the credit risk industry. I also provided some of the learnings gained from these experiences.

The article proved to be very popular with our readers, so I decided to dedicate the last two articles of this year to more of these stories.

Here are three stories, from different parts of the world, and for obvious reasons all names and institutions have been anonymised.

“Stories are our primary tools of learning and teaching, the repositories of our lore and legends. They bring order into our confusing world. Think about how many times a day you use stories to pass along data, insights, memories or common-sense advice.”

Edward Miller, founder of Edward Elementary, illustrator and product designer.

The Best Credit Bureau Score in the World!

This story occurred at a large industry conference in Florida and will forever linger in my mind, as it was so outlandish!

Pre-Covid, industry conferences were big deals and were attended by thousands of employees, partners, vendors, clients and prospects. At this one particular event I had the pleasure of meeting the founder of a credit bureau in the Caribbean. The post-sessions drinks were flowing and all of a sudden, he had an outburst stating, “I have the best credit bureau score in the world!”

Somewhat bemused at this bold statement I asked, “Why on earth do you say that?”

To which he retorted, “Because I have 1,500 different characteristics in my scorecards.” I thought I had misheard and so tried to confirm “don’t you mean candidate characteristics, that you looked at prior to the final models being developed?”

He repeated himself, “No! I have over 1,500 characteristics in my scorecards. They are the best credit bureau scorecards in the world!”

I made my excuses and left the conversation as this was clearly ludicrous. Credit bureau scorecards perhaps had 10% of this number as candidate characteristics. Even a market such as the USA, with 100 times the size of the population that could be sampled, had nowhere near this number of scorecard characteristics in the final credit bureau score models.

Learnings

- A little knowledge can be a dangerous thing.

- More is not necessarily better.

- It is a sad fact that many clients and prospects underestimate the skills and experience that are required to develop robust scoring models.

- Trying to monitor and report on so many characteristics would be a Herculean task.

I often wished I had stuck around to ask him how many analysts he employed to track the 1,500 scorecard characteristics, 95% of which would add zero value to the final model.

Credit Risk Control Manager

One of the toughest design sessions I can ever recollect was with a private label cards company in South Africa. This client had launched cards via a joint venture with a big bank and the relationship was not going well.

The retailer had been aggressively issuing cards for about a year and the bad debt was piling up. The bank then flexed its muscles and insisted on taking over the credit risk management function. In parallel to this, the retailer had invested in a decision engine to manage the accounts and so here we were trying to take them live with brand new strategies amongst what could be best described as a ‘political minefield’.

We had been forewarned about the situation, but nothing prepared us for the credit risk manager that the bank had parachuted in. He was an ex-collections manager of many years and so saw everything through a collections prism, rather than credit risk.

We spent about a week with ‘Collectosaurus Rex’ trying to design and get sign-off on simple and conservative credit limits strategies, but had our hands tied due to his mantra of “we cannot give them increases, they will spend it!” (Isn’t that the whole idea of increasing limits?)

For limit increases we finally received agreement to increase accounts with odds of 960/1 or more (out of 961 accounts with that score, only 1 was predicted to go bad). This represented just 2% of the portfolio and most of these ‘super goods’ wouldn’t qualify as these are also the type of accounts that rarely used the card, or only for a tiny fraction of the limit.

Most of the discussion centred on credit limit decreases and his initial stance was that all accounts that went delinquent should be decreased. This provoked days of debates, as South Africa is a ‘slow pay’ market, where a very high percentage of the accounts will roll to 1 and 2 cycles delinquent but will then pay when reminded. These are actually card issuers most profitable accounts due to the high levels of interest and late fees income that they generate.

We finally managed to get agreement on a less draconian approach, but it was still against consulting advice. The strategies that year resulted in overall decreases in the total and average limits of the portfolio’s accounts, which was a first for me and this, thankfully has never been repeated.

Thankfully the ‘wheel turned’ and for the following year the client replaced the dyed-in-the-wool credit ‘control’ manager, with a true credit ‘risk’ manager.

Learnings

- Sometimes politics overrides common sense, and you need to identify when to stand up against the system and when to just go with the flow.

- In some emerging markets there is a prevailing suspicion of credit and granting credit. These views are often very hard to shift as they have been built up over many years. The best approach is to try and work around these people.

- Banks and retailers have been described as being like ‘oil and water’ and they rarely ever mix well.

Pile it High and Set the Cut-off Low

This story is the direct opposite to the previous story where we struggled to get agreement on increasing more than 2% of the portfolio’s accounts.

I was consulting with a bank in the Arabian Gulf that had just introduced behaviour scoring and account management strategies, so it was a huge change in how the credit risk department operated.

Historically if a customer required a limit increase, they would call the bank and after a conversation, a request would be put through to the credit risk management team to review the account and make a decision.

In those days, banks competed by providing ever-higher limits and so any increase less than the equivalent of USD 5,000 was considered to be an insult to the customer!

In addition, it was very, very rare to ever decline a manual increase request, as nobody wanted to call the customer and tell them this.

Enter automatic credit limit strategies…

We spent most of the week trying to rein-in the limit increase amounts, as they wanted the equivalent of USD 5,000 to be the minimum increase! However, the longest discussions were around the minimum behaviour score cut-off that would make an account eligible for an increase.

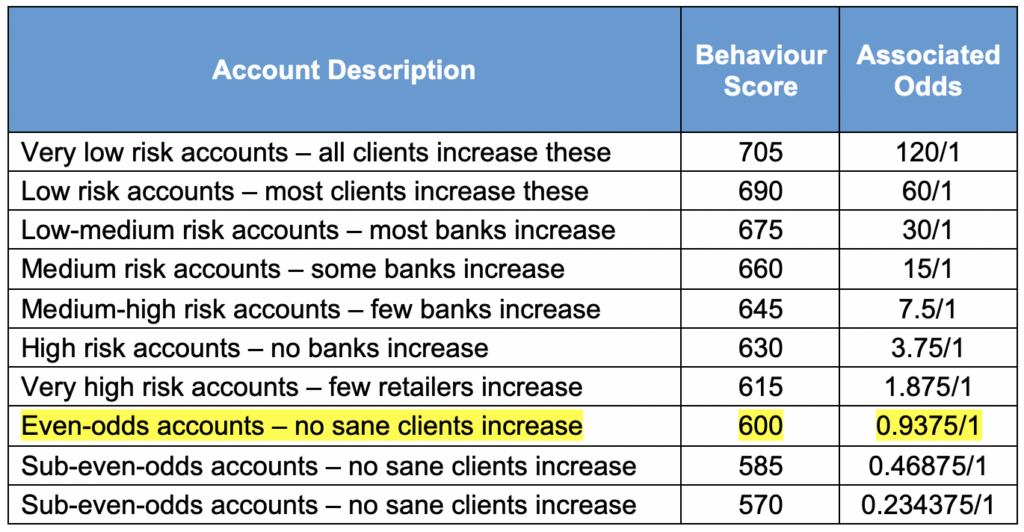

A whole day was spent explaining the behaviour score to odds ratios:

After the whole day explaining how the score to odds ratio works and carefully focusing on the fact that a behaviour score of 600 would result in slightly less than even-odds, i.e. accounts with less than a 50% chance of staying good, we thought we had the client ‘bought in’.

Imagine the surprise and disappointment when we asked the next day, “what minimum cut-off would you like to use for the accounts? 660/675/690/705?” Only to receive the response “none.”

This client was so culturally trained to always say “yes”, the concept of excluding any current accounts for increases was completely alien to them.

The discussion became very heated as we tried countless times to explain that by increasing accounts with a behaviour score less than 600, they were effectively betting against themselves.

At one point, out of sheer frustration, I reached into my pocket, pulled out all of the small bank notes that I had and threw them into the air, describing this action as the same as what they were proposing doing.

There was a hush in the room, and I mistakenly thought that I had finally made my point clear, until somebody explained that what I had just done could be interpreted as insulting the royal family. A cold chill went down my spine and that’s when I realised this was an argument that we would not win in year one.

We finally, finally had them compromise on excluding all sub behaviour score 600 accounts from automatic increases, but we still had to go live with the lowest cut-off I have ever seen for limit increases, with minimum odds of 0.9375/1.

Luckily nobody in the room placed a complaint with the authorities, but I did have a few sleepless nights waiting for a knock on the hotel door!

Learnings

- In some cultures, saying ‘no’ is not an option.

- Always be culturally sensitive and avoid any form of perceived insults.

- Be patient, sometimes making a change will take a number of iterations, rather than a direct progression from A to Z.

- Credit risk is perceived very differently across different countries.

Summary

If you enjoyed these stories, please let me know and I can always add future articles with additional tales, of which there is no shortage of!

As mentioned in the introduction, and to paraphrase the disclaimer always used in American TV series, “…no identification with actual persons (living or deceased), places, buildings, and products is intended or should be inferred.”

However, I have added learnings to each story, and these should be taken on board by the reader, as they have helped me greatly in this industry over the years.

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and credit risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing fintechs with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.