Stories & Learnings from a Career in Credit Risk Part 4

Introduction

Last month we published a couple of light-hearted pieces about some of the funny or strange things I have encountered in my many years in the credit risk industry. I also provided some of the learnings gained from these experiences.

The two articles proved to be very popular with our readers, so we decided to start off the new year with two more of these light hearted collections of stories.

Here is a collections story and for obvious reasons all names and institutions have been anonymised.

“Stories are memory aids, instruction manuals and moral compasses.”

Aleks Krotoski, author, broadcaster, journalist and social psychologist

Collectosaurus Rex Part 2

I mentioned ‘Collectosaurus Rex’ in a previous collection of stories, but to refresh readers memories, here is the background information.

One of the toughest decision engine strategy design sessions I can ever recollect was with a private label cards company in South Africa. This client had launched cards via a joint venture with a big bank and the relationship was not going well.

The retailer had been aggressively issuing cards for about a year and the bad debt was piling up. The bank then flexed its muscles and insisted on taking over the credit risk management function. In parallel to this, the retailer had invested in a decision engine to manage the accounts and so here we were trying to take them live with brand new strategies amongst what could be best described as a ‘political minefield.’

We had been forewarned about the situation, but nothing prepared us for the credit risk manager that the bank had parachuted in. He was an ex-collections manager of many years and so saw everything through a collections prism, rather than credit risk.

We spent about a week with ‘Collectosaurus Rex’ trying to design and get sign-off on simple and conservative credit limits strategies, but had our hands tied due to his mantra of “we cannot give them increases, they will spend it!” (Isn’t that the whole idea of increasing limits?)

We finally managed to get agreement on a less draconian approach, but it was still against consulting advice. The credit limit strategies that year resulted in overall decreases in the total and average limits of the portfolio’s accounts, which was a first for me and this, thankfully has never been repeated.

For the second week we had the pleasure of working with ‘Collectosaurus Rex’ designing new collections strategies, which were intended to manage the large influx of delinquent accounts that was occurring.

This time the dyed-in-the-wool ex-collections manager and newly appointed credit risk manager had a new mantra: “hit them hard, hit them early.” This was his guiding principle for the next two weeks of meetings (we had to extend by an extra week!).

We started off the design with a typical collections strategy, using the principle of ‘centre and tilt.’ This time-tested principle works very well as it swaps out the lower risk accounts (decelerated actions) with the higher risk accounts, (accelerated actions), enabling a more focused approach to collections.

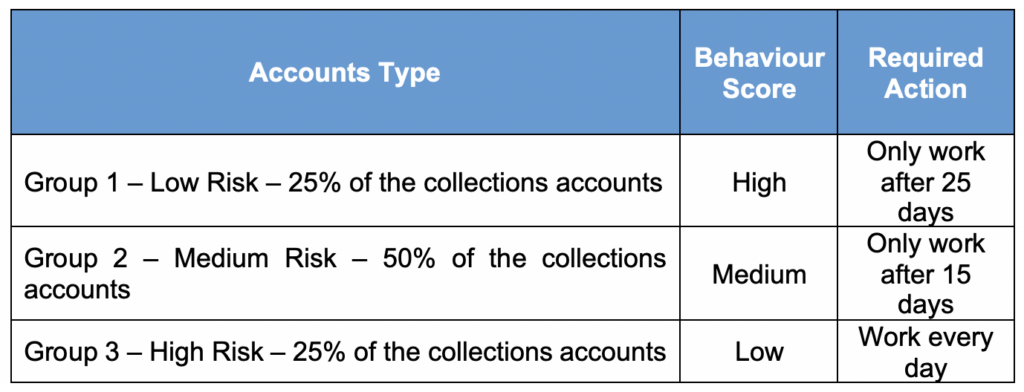

The ‘centre and tilt’ approach is a cornerstone of collections management strategies as it leverages the predictive power of behaviour scores. An example can be seen below.

What the centre and tilt strategy looked like:

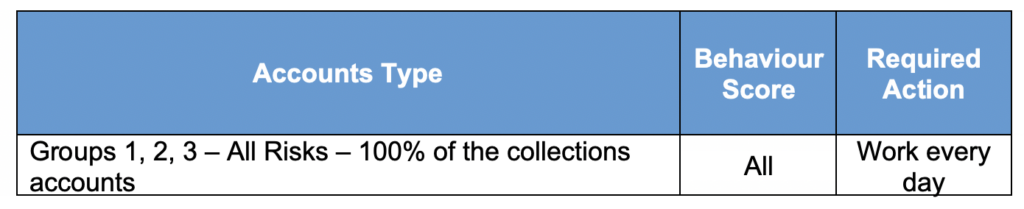

Unfortunately for us, the mind of ‘Collectosaurus Rex’ had been made up well before the design sessions. All accounts, regardless of behaviour score, balance, delinquency or status were to be queued into the new predictive dialler from day one.

What the client wanted:

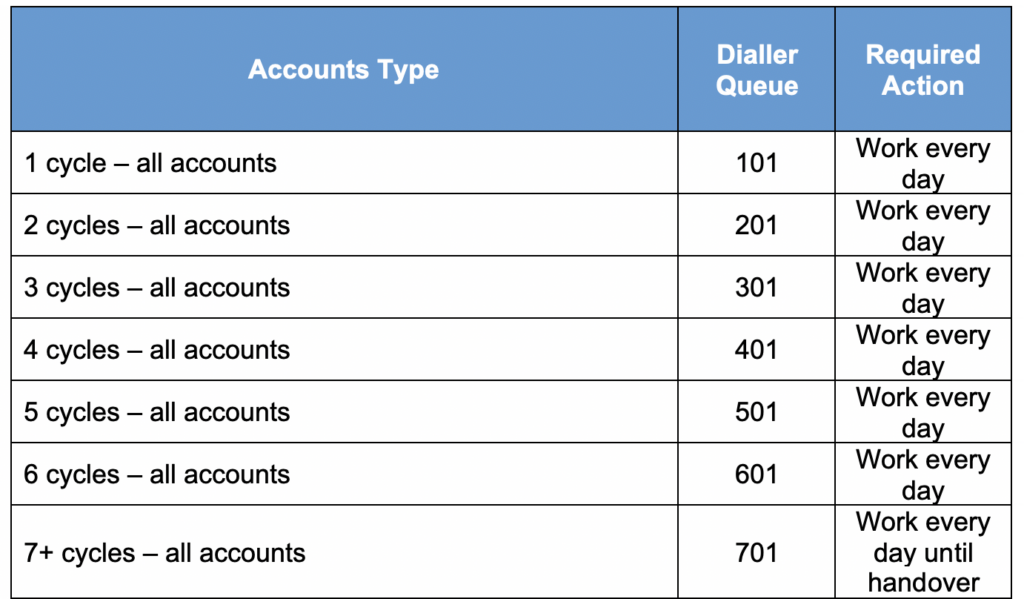

Over the course of the two weeks of heated discussions, it became apparent that the investment in the new decisioning system would not be used for collections and we ended up with the world’s smallest delinquency strategy, with just 7 branches, segmented by cycles (months) delinquent.

The ‘hit them hard, hit them early’ collections strategy:

Needless to say, this approach proved to be a disaster, as the dialler team could not handle the volumes, there were many upset customers and collections results went through the floor.

After about 4 months of this strategy, we were finally allowed to implement a challenger strategy using the predictive power of the behaviour scores and balance cut-offs. By the end of the first year of tests, the challenger completely replaced the ‘hit them hard’ strategy and this also marked the departure of Collectosaurus Rex from the premises.

Learnings

- Not all clients will listen to external consultants.

- If you face a block, then negotiate to run a champion/challenger test. The beauty of A/B testing is that the results will speak for themselves.

- Sometimes life is a case of two steps backwards before you can eventually move forward.

- Always keep an open mind to new ideas. These are sometimes from the client and sometimes from the consultant.

Summary

As mentioned in the introduction, and to paraphrase the disclaimer always used in American TV series, “…no identification with actual persons (living or deceased), places, buildings, and products is intended or should be inferred.”

However, I have added learnings to each story, and these should be taken on board by the reader, as they have helped me greatly in this industry over the years.

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and credit risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing fintechs with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.