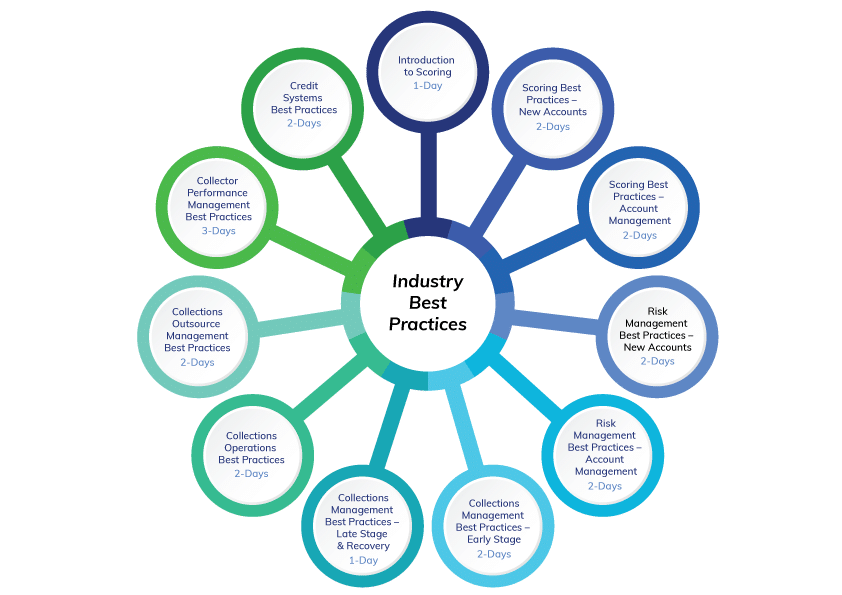

Our Credit Risk Training Programme includes 11 courses ranging from 1 to 3 days and can be customised to suit your specific requirements.

Credit Risk Training Programme

We have assembled a dedicated credit risk training programme focused on the consumer credit and risk industry. With 25+ years of experience, our credit risk experts can deliver 11 specialist online courses which are unique to the industry and have proven to be popular worldwide.

In all of the 11 online courses, delegates are exposed to a series of presentations, case studies and exercises – all based on international best practices.

Through this interactive approach, attendees can return to their work environment fully equipped to implement the best practices, tips and strategies covered in the online courses.

Credit Risk Training Programme Courses

A series of 11 specialist online credit risk training courses have been developed, ranging from one day to three days and introductory level to advanced status.

Through this series of online courses, experts in the credit risk management, collections, scoring and analytics arenas focus on a wide range of topics:

All online courses are presented by our team of experts, who have extensive experience in the global consumer and SME credit industry.

All presenters have an established track record of providing results-driven credit risk consulting and successful implementations of analytics, scoring, decisioning and collections systems, and decisioning strategies at a wide range of clients.

Our team of experts has delivered a wide range of credit risk training assignments for over 2,000 delegates from over 100 organisations based all over the world.

Assignments have ranged in scope from 5-days of customised training to the development of a full 20-day credit risk training programme, covering key topics in credit risk, predictive analytics, scoring, collections and credit systems.

Each training assignment has provided maximum flexibility and has been completed to the highest standards, within budget and delivered on time.

Our personnel have a unique combination of established markets expertise, combined with emerging markets experience. This ensures that the online training courses are delivered to match the specific client’s requirements.

Our team has expertise covering the entire credit life cycle and we have been commissioned to complete numerous training, research and development initiatives, including:

The credit risk training programme is practically focused, and concepts are reinforced using best practice case studies and exercises. This approach, combined with highly experienced presenters, ensures that delegates return to their work environments with a clearer understanding of the course content.

The lively debate and interaction between delegates and presenters guarantee an enjoyable yet valuable learning experience.

All attendees receive the training programme online materials, which can be used for future reference and ongoing learning. In addition, a digital certificate is awarded to all delegates who complete each seminar.

Customised Credit Risk Training Programmes

If you would like to customise any of these seminars for your specific requirements, e.g. creating a one week programme focused just on scoring, credit risk management or collections, then please do not hesitate to let us know your requirements.

We will be delighted to create a customised training programme for your specific needs.