What is a Decision Engine?

Part 2 – Decision Engine Core Functionality

Introduction

If you ask three people “what is a Decision Engine?,” you will probably get at least five different answers. For an application that has such a straightforward and descriptive name, there is a lot of confusion and misunderstandings about what a Decision Engine actually is and what it does.

In this two part series, describing what we believe a Decision Engine to be, we will examine the question from opposite perspectives:

- Part 1 – what a Decision Engine is not.

- Part 2 – what a Decision Engine truly is.

In this second article in the series, we examine the core components and functionality of a Decision Engine.

Please note that for this series of articles, we are only examining a Credit Decision Engine, focusing on an Originations use case.

Why use a Decision Engine?

The success of any lending business relies on the ability to identify appropriate customers and provide them with the appropriate products and services that they need.

A Decision Engine enables business users to implement and manage all aspects of the lenders credit strategy. It also comes equipped with a wide range of functionality which enables users to drive the core competencies of the lending business.

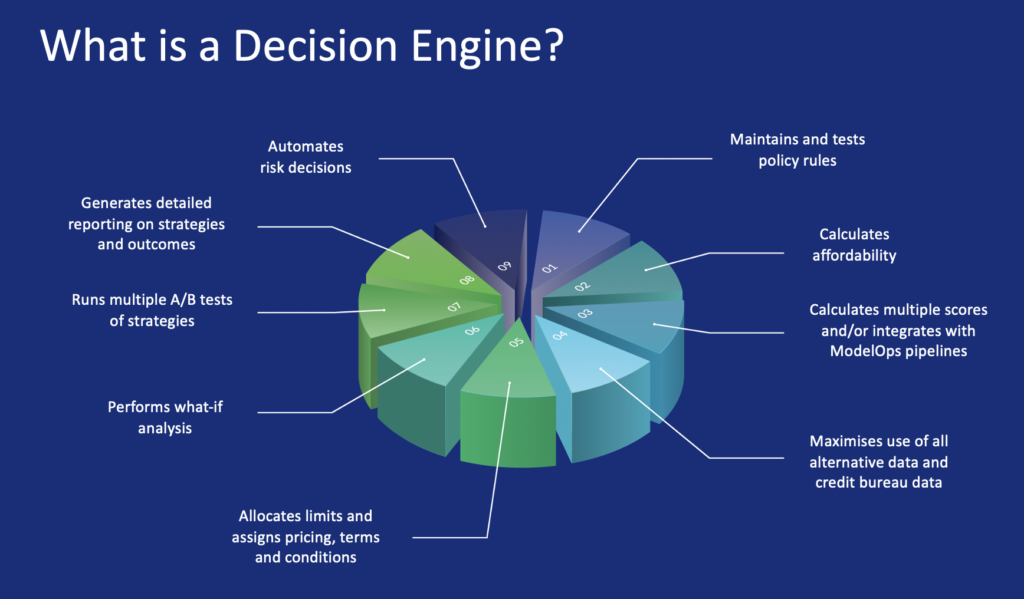

These points can best be summarised in the following diagram:

Figure 1. Benefits of a Decision Engine.

Core Components of a Decision Engine

As the credit industry has matured, expectations of a Decision Engine’s functionality have grown exponentially. These key components can best be viewed in the following diagram:

A listing of all the benefits of having a decision engine

Figure 2. What is a Decision Engine?

The following is a list of components that a fully-fledged decision engine will provide, to enable organisations to optimise their credit assessment.

Automates Risk Decisions

A Decision Engine automates and manages the real-time decisioning on new applications, based on the lender’s credit policies and risk appetite. The key objectives of a Decision Engine are to manage applications using well-defined policies and strategies, calculate affordability and determine the appropriate value of credit to be granted to the applicant, whilst at the same time aligning the pricing terms and conditions with the applicant’s risk profile.

Maintains and Tests Policy Rules

Policy rules are implemented directly into the Decision Engine editable rule library. Most Decision Engines allow for unlimited rules, ranging from basic to highly complex. In addition, the library of policy rules enables continuous modification and deployment by business users.

Applications that fail the initial policy rules will be declined or referred.

Calculates Affordability

The applicant’s affordability, or disposable income is calculated, making use of a client provided affordability calculation and any data elements that have been passed to the Decision Engine in the application call.

The risk and affordability weighted repayment amount is then assigned to the applicant, which then drives the maximum lending amount that the customer qualifies for.

Calculates Multiple Scores

A Decision Engine will calculate scores based on application, credit bureau and alternative data.

Traditional scorecards can be easily implemented in the decision engine, and Adverse Actions can be used to provide feedback to your frontline staff regarding the reasons why an application may have been declined. Complex calculations can be configured directly in the system to derive scorecard characteristics.

A good Decision Engine will provide full support for multiple scorecard types, with traditional additive models, logistic regression models, tree-based models and neural nets all supported within the system. The internally derived application score can also be used in conjunction with any externally calculated scores (e.g. credit bureau scores).

Credit Bureau and Alternative Data

A Decision Engine enables subscribers to retrieve data from any credit bureau that is available. The Decision Engine performs the call to the selected credit bureau by means of an API integration, retrieving the standard bureau data response for use in decisioning.

Pre-bureau policy rules can be defined, ensuring that calls to the credit bureau are only made when the application is valid i.e. applications that will fail regardless of the bureau data can be declined prior to the credit bureau call, saving the lender the cost of bureau data retrieval.

Many credit granting organisations make use of non-traditional scores to assess their applicants, which are provided by third party providers who aggregate and create models using alternative data.

A Decision Engine perform calls to these third party data providers, on behalf of the client. This interface is generally smaller in nature, returning only a score, and possibly a number of other variables to describe that score.

Allocates Limits, Pricing, Terms and Conditions

A good decision engine will support a flexible strategy process. Particularly in the credit originations space, the variety and sequence of decisioning can vary significantly from one lender to another, and particularly across different credit products.

This flexible approach enables lenders to configure a wide variety of decisioning outcomes, including not only the Accept/Decline decision and loan size, but any other decisions that the credit risk team may wish to make at the same time. This could include pricing terms, maximum and minimum loan tenure, ancillary products to be offered, etc.

By adding these additional levers into the application assessment, organisations can have a far greater control over their own profitability.

Performs What-If Analysis

When credit risk managers and analysts make changes to strategies, it is best practice to analyse those changes to understand what the combined impact is likely to be on the portfolio. This should be done before releasing the strategy into production.

A good decision engine will provide built-in What-if analysis capability, enabling business users to easily run historic application data through strategies to measure their expected impact. The decision engine creates side by side comparison reports between the existing and new strategies, which show the business user the expected changes in the relevant metrics.

Runs Multiple A/B Tests

A good decision engine provides business users with the ability to simultaneously assign multiple decision strategies to the applications. A/B testing is then conducted on a random allocation of applications in each different strategy.

The Decision Engine assigns a test number to each application that is received. Strategies can be assigned to percentages of the base, meaning that not only can new strategies be tested on a random selection of applications, but also that business users can select what percentage of applications each strategy receives.

Applications can be monitored by the strategy that is assigned to determine which strategy is the most profitable for the business. This ability to A/B test different strategies is paramount to controlled credit risk management and the process is known as ‘test and learn.’

Generates Detailed Reports

A Decision Engine should include reporting that is focused on the elements that make up the credit decision. Strategies and scorecards require specific types of reporting to enable business users to monitor their effectiveness.

For scorecards, population stability and characteristic analysis reports are crucial to monitor potential shifts in the applicant population that will cause the scores to shift.

Strategy reporting allows for deep dive analysis on the outcomes of each strategy that is assigned in production. Every element of decisioning within the strategy should be broken down for analysis, enabling the credit risk team to gain insights on the performance of their A/B tests.

Dashboards

A good Decision Engine should ideally include quick reference dashboards that can be accessed by business users at any time to track credit decisioning KPIs. These dashboards make it possible for the credit team to track trends in acceptance rates, score distributions, limit allocation etc.

Summary

Using a variety of advanced scorecard types, complex mathematical calculations to determine disposable income and affordability, and simultaneous deployment of multiple competing strategies, a modern decision engine is crucial to the success of any credit granting organisation.

Hopefully, this two-part series focused on Decision Engine functionality has now created some clarity as to what a Decision Engine is and what it is not. It is true that all Decision Engines will differ, but modern full-feature ones will tend to have all of the described functionality.

About the Author

Stephen John Leonard is the founder of ADEPT Decisions and has held a wide range of roles in the banking and credit risk industry since 1985.

About ADEPT Decisions

We disrupt the status quo in the lending industry by providing lenders with customer decisioning, credit risk consulting and advanced analytics to level the playing field, promote financial inclusion and support a new generation of financial products.